Do you have questions about the GTA real estate market? Reach out to learn more about your local market—and how we can help!

How Much Would Your Home Sell For Today?

We can help. Just let us know a bit more by filling out the form below.

05.28.20 | For Buyers

Do you have questions about the GTA real estate market? Reach out to learn more about your local market—and how we can help!

We can help. Just let us know a bit more by filling out the form below.

04.15.20 | For Sellers

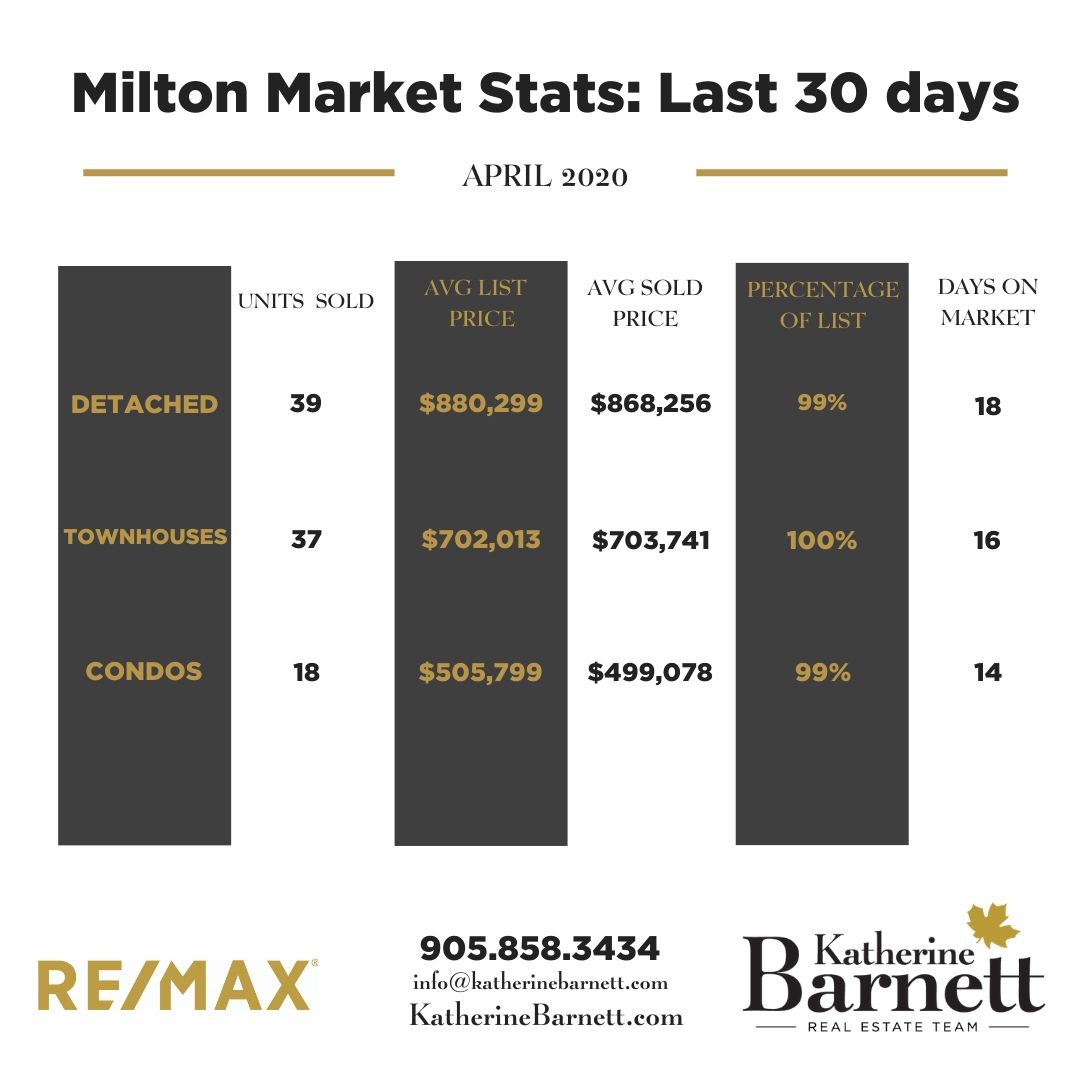

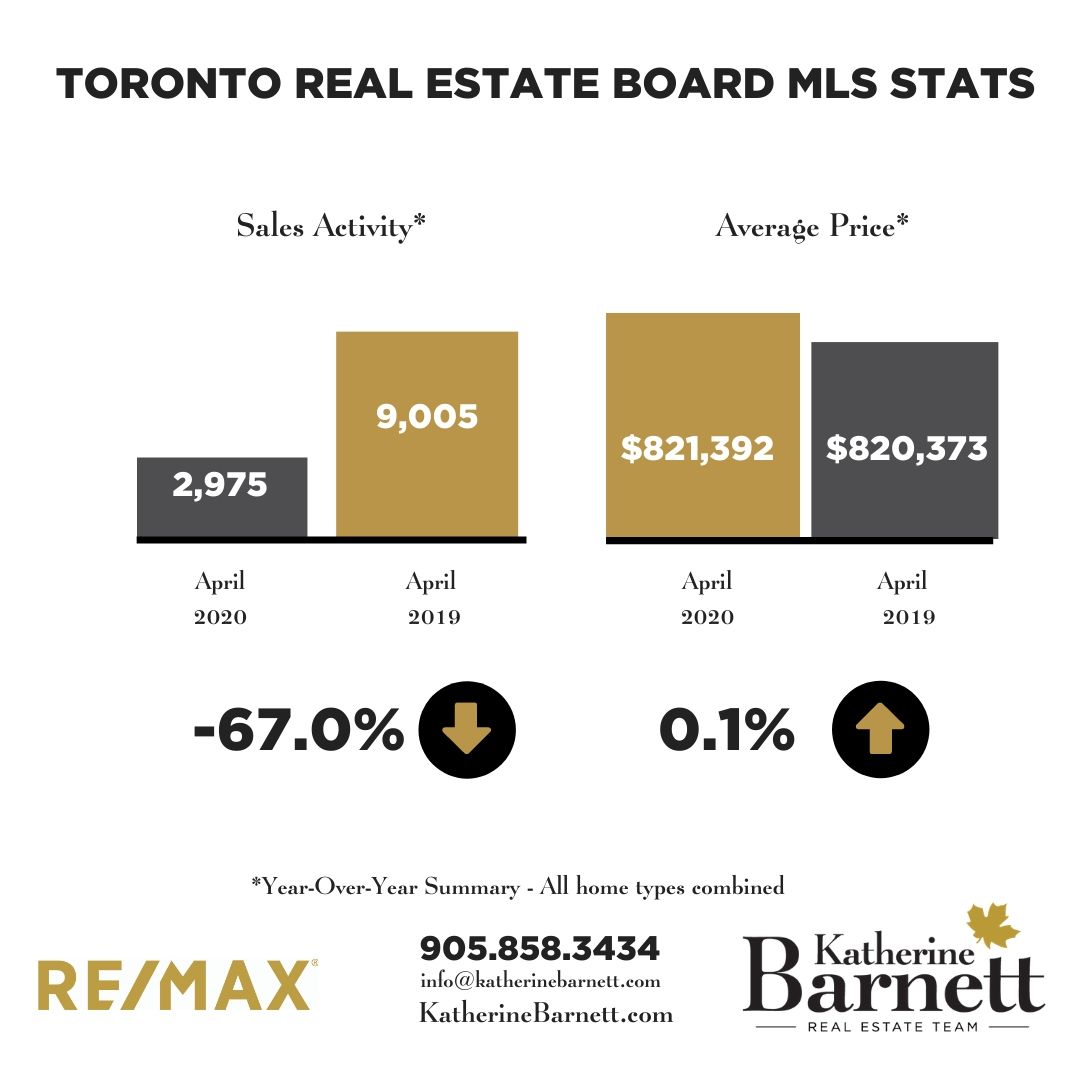

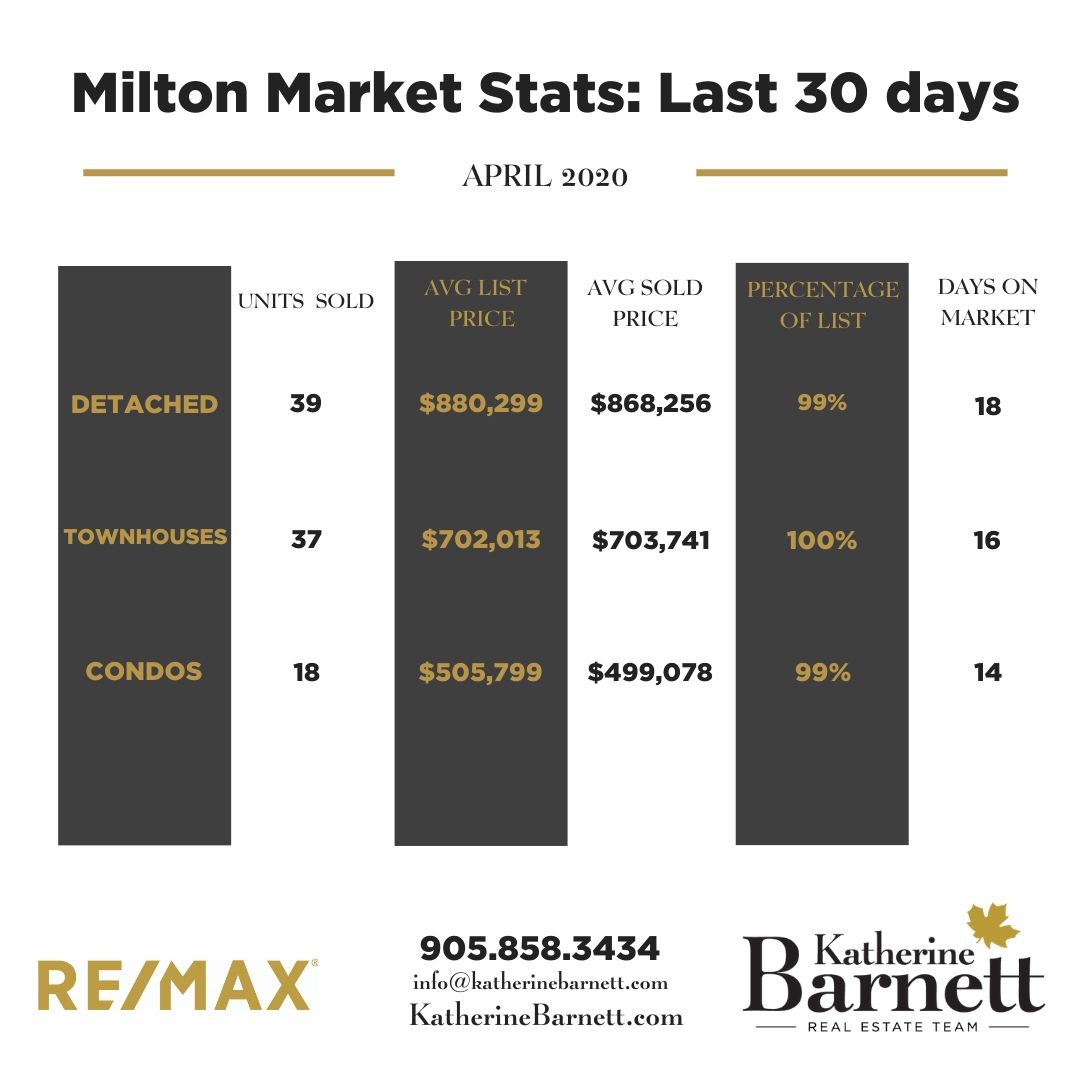

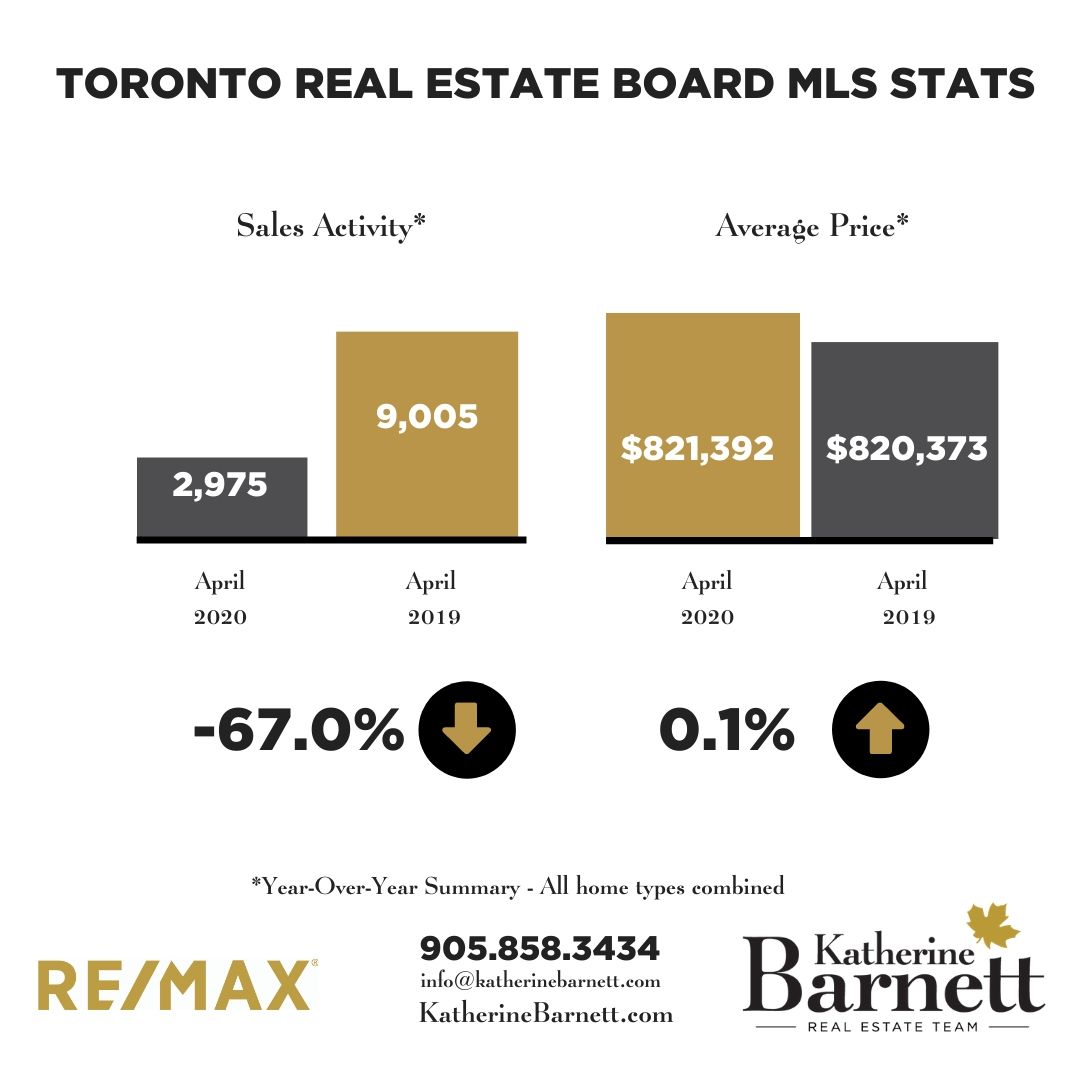

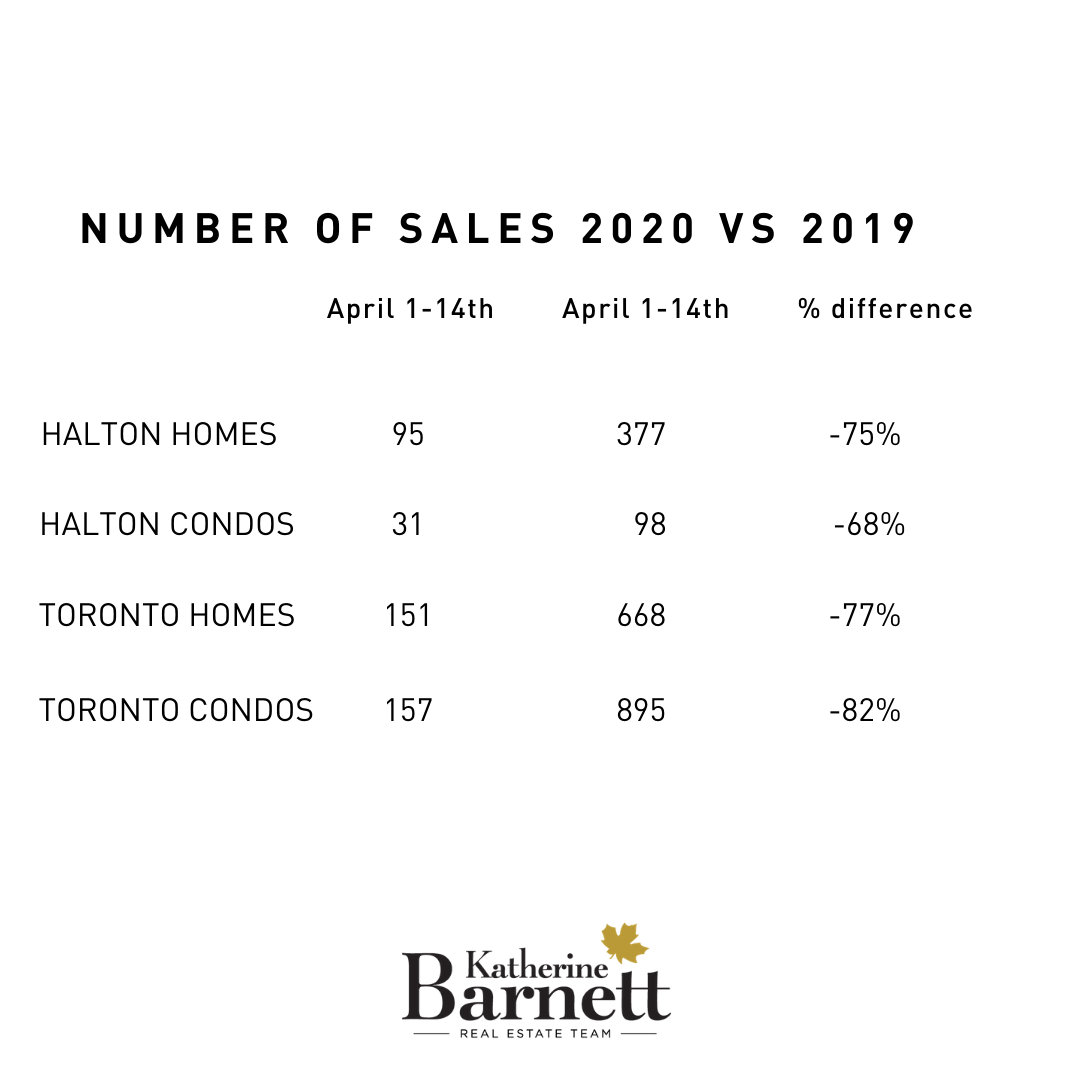

As you can see from the chart, the sales have dropped off dramatically, this has happened in steps, with fewer and fewer sales as more closures were put into place due to COVID-19 and things changed.

Real Estate was deemed essential, so we are continuing to work remotely for our clients who need housing, but we are not business as usual. Many things have been put into place to embrace social distancing and remote home sales but only for those that really need to buy or sell.

We were in the middle of a very busy hot spring market when COVID hit. Now, it’s like a big pause has been put on buying and selling.

So far prices have not taken a big hit. Keep following us for regular updates.

Until then…

04.13.20 | For Buyers

During this period of uncertainty, we ask you to consider supporting our local Milton restaurants.

Whether it’s ordering a meal or purchasing gift cards to be used at a later date, your help is truly appreciated.

We’ve put together a list of local Milton restaurants, hours, and how to get food from them.

Take out & Delivery within a 5km radius

Thursday – Sunday: 12:00 -7:00 pm

289-878-7489

Curbside pickup & Delivery

(289) 878-4945

Pickup & Delivery

Friday – Saturday: 5:00 – 9:00 PM

Place orders by email: Theradbrothers@gmail.com

(905) 875-1119

DOORDASH delivery & Curbside pickup

11.30am to 9.00pm

(905) 693-1992

CURB-SIDE PICKUP& DELIVERY

Tuesday – Sunday: 4:00pm-8:30pm

Monday: CLOSED

(905) 878-1933

Pickup & Delivery

Online Delivery: Skip the Dishes, Uber Eats & Door Dash

Daily: 10:00 am – 7:00 PM

(905) 878-8783

Curbside pickup & Delivery

(905) 854-1234

Curbside pickup

(905) 693-8345

Pick-Up + Skip the Dishes Delivery

Monday – Wednesday: 12pm – 9pm

Thursday – Sunday: 11:30am – 10pm

(905) 876-4899

Delivery and Pickup exclusively through SkipTheDishes.

Thursday – Sunday: 4:00 -9:00 pm

Curbside pickup

(905) 693-0113

Pick-Up & Delivery

Monday – Saturday: 3:30pm – 9:30pm

Sunday: 3:30am – 8:30pm

Delivery

Text to order 289-971-7006

Pickup & Delivery

Skip the dishes & Uber Eats

(905) 864-9442

Pickup & Delivery

Skip the Dishes

(905) 864 9779

Pickup & Delivery

(905) 876-1414

Takeout & Delivery

Delivery through SkipTheDishes, UberEats and DoorDash.

(905) 636-1434

Curbside Pick-Up

Tuesday – Saturday: 11:00am – 6:00pm

905-878-0406

Takeout & Pickup

Monday – Saturday: 7:00am – 2:00pm

(905) 693-0404

Pickup & Delivery through SkipTheDishes

(289) 270-0919

Curbside Pick-Up

Tuesday – Sunday: 12:00 pm – 7:00 pm

(905) 878-7934

Pickup & Delivery

Wednesday – Sunday: 4:00 – 8:00 PM

(905) 693-0100

Takeout & Pickup

Monday – Friday: 8:00 am – 6:00 pm

Saturday: 8:00 am – 5:00 pm

(905) 878-2938

Online order for Pickup & Delivery with Skip the Dishes

Daily: 11:00 am – 8:00 pm

(905) 875-0700

Pickup & Delivery

Monday – Friday: 9:00AM – 2:00PM

Email orders to lunchboxcafe@clnh.on.ca

Takeout & Pickup

Daily: 11:30 am – 7:30 pm

Email inquiries and orders to Info@Door3090Catering.com

Curbside Pickup, Delivery & Uber Eats

Email orders to info@larosebakery.com

Daily: 8:30 am – 4:00 pm

Pickup & Delivery

(905) 636 0044

Curbside Pickup & Delivery

(289) 851-8883

Pickup & Delivery

Online Delivery: Skip the Dishes & Uber Eats

(905) 693-6367

04.8.20 | For Buyers

While real estate is deemed essential, it is not business as usual, we are taking extra measures to keep our clients and ourselves safe.

Our team is all working remotely. We are here to help our clients who need to buy, sell or rent during this difficult time in many different ways.

We offer virtual consultations, video meetings, matterport videos for our listings, HD videography and photography, digital floor plans, virtual showings, FaceTime showings and digital signatures.

Our top concern is our client’s needs and everyone’s safety at this time.

Feel free to reach out to our team if you have any questions or if there is anything we can do to help you at this time.

Stay safe and stay home.

03.16.20 | For Buyers

01.29.20 | For Buyers

There’s no denying that Canadians value the idea of buying real estate. In spite of all the housing policies and promises, bubble rumours, speculation and trepidation, 51 percent of Canadians are still planning to purchase a home in the next five years. This number is up from 36 percent at the same time last year.

Homeownership is a great way to build future wealth, but it’s not for everyone. Ultimately, buying a home is a very personal decision that depends on a number of factors, such as your financial fitness, your future plans and your overall comfort level. The good news is, professional real estate agents, mortgage brokers and real estate lawyers are there to advise you before you dive in.

To help get you thinking about whether homeownership is right for you, here are five important questions to ask yourself.

Buying real estate involves up-front costs, which can include things like your deposit, downpayment, home inspection and appraisal fees, property insurance, Land Transfer Tax, title insurance, legal fees and moving expenses.

Then, there are your ongoing costs that include property tax, regular maintenance, condo fees and utilities. If you’re saving some money up-front by buying a fixer-upper, also factor in renovation costs.

When buying real estate, most people will take on a mortgage. Lenders evaluate your costs versus income to determine your qualification. Your Gross Debt Service ratio is your housing costs (mortgage principal and interest + property taxes + heat) divided by your pre-tax income. The result should be 32 percent or less.

Then, lenders look at your Total Debt Service ratio: all debt (GDS + car payments + alimony + other loans) divided by your pre-tax income. This should be less than 40 percent.

Click HERE to calculate your GDS and TDS.

Think about this honestly. Is business bustling? Is the industry on an upward or downward trend? Are you comfortable with the financial commitment of homeownership?

Speak to your supervisor to get some additional insight. Mortgage lenders like to see stable employment, and you’ll need to provide proof of income in the form of an employment letter or current pay stub, your position and length of employment, and if you’re self-employed, Notices of Assessment from the Canada Revenue Agency for the past two years.

Click HERE to find out what else mortgage lenders look for.

Buying real estate has historically proven to be a good long-term investment. Ask your parents how much they paid for their home 30 years ago, and compare that to the home’s value today. On the other hand, a quick sale can mean financial losses if the home’s appreciation doesn’t surpass closing costs, which are estimated at 1.5 to five percent of a home’s value.

Typically, the magic number to stay in the home before putting it back on the market is five years – hence the five-year plan.

People buy homes for a slew of different reasons. Homeownership is a method of forced savings for retirement and future generations, while also fulfilling the basic need of providing you shelter. It’s also a great source of pride for many.

It’s a place to live, but also the lifestyle that comes with it. What does “liveability” mean to you? Picture yourself in five years. Do you plan to relocate at some point? Where will you work? What’s your family structure? Then, consider how homeownership fits into that vision.

11.13.19 | For Buyers

The Ontario government is updating the province’s real estate rules for the first time in nearly 20 years in a move it says improves consumer protection and gives the real estate industry regulator more latitude to immediately sanction or fine agents and brokers who violate the profession’s ethics and regulations

The 2002 Real Estate Business Brokers Act (REBBA) is being renamed The Trust in Real Estate Services Act. The bill will provide homebuyers and sellers with more information and more choices.

Between January and March 2019, almost 7,000 consumers and real estate professionals responded to an online government survey and consultation paper about potential changes to the act. The Trust in Real Estate Services Act, if passed by the legislature would address the need for a stronger and more ethical business environment, to protect consumers when making their biggest purchase.

“The real estate market in Ontario, and quite frankly across Canada, has seen enormous changes since the act was first passed 20 years ago,” she said. “Economically real estate is booming. Between 2005 and 2015, the total value of all residential properties more than doubled in Ontario.”

“This will make Ontario a leader again when it comes to having faith in your real estate professional,” said Tim Hudak, CEO of the Ontario Real Estate Association (OREA).

Under the revamped legislation, home sellers would have the option of disclosing competing offers in a multiple buyer situation.

The current rules require selling agents to tell all potential purchasers how many offers have been submitted for a property but they cannot disclose the monetary or other conditions of those offers.

The government is also changing the language around transactions where the buyer and seller is represented by the same brokerage — a practice commonly called double-ending.

The word “customer” will be eliminated from the forms and language used in those transactions. A consumer will either be a client to whom a fiduciary duty is owed or they are self-represented.

The idea is to make it clear that while the same brokerage can provide information to both parties of that transaction, it can really only represent and work in the best interest of either the buyer or the seller.

RECO will also be able to immediately levy administrative fines to agents and brokers for relatively minor infractions such as breaking advertising rules or failing to provide a monthly reconciliation of accounts held in trust by the brokerage. Its ability to issue fines or order education for rule-breaking agents and brokers will be expanded and streamlined to allow RECO to sanction those violators more quickly.

“That’s a big thing for us. Today if we want to revoke somebody (take away their registration) we usually go to provincial offences court and then we would use that to get the charges for bad conduct and then we go to licence appeal tribunal,” he said.

Brokers will still be able to appeal but it will be a single-step process through the provincial Licence Appeal Tribunal.

Giving RECO the power to act quickly to revoke the licenses of realtors “for more egregious violations of the code of ethics — taking advantage of consumers,” will result in higher professional standards, Hudak said.

The association that represents 86,000 agents, brokers and brokerages says the modernized real estate legislation will allow agents to incorporate so that they can defer some of their income and better ride out the highs and lows in the business cycle.

10.23.19 | For Buyers

Elections tend to unearth the hot ticket items that have Canadians worrying. A major cause of worry for Canadians today is housing. People who still rent are more stressed out as affordability continues to pose a challenge. This is for both rent and the idea of owning a home.

In fact, 93 percent who rent are experiencing a negative impact on their lives due to housing worries. But homeowners aren’t that much far behind on the worry scale with 80 percent agreeing the cost of buying a home is rising much faster than their incomes.

Now that the Liberals have won a minority government, how will it affect Canadian real estate? Here we look at the promises and how the Liberals’ 2015 housing platform fared, to get a better idea of what might happen.

So, what has the Prime Minister actually promised? Here is what the Liberals are planning:

Changes to GST rebates on new capital investments in affordable rental housing are estimated to generate $125 million per year in tax incentives. This is intended to help increase the affordable rental supply for housing across the country.

Other incentives to make purchasing a home more affordable include a one-per-cent federal tax on vacant properties owned by non-Canadians who live abroad. This worked in B.C. but in Toronto, the rate of foreign purchases is quite low. So, whether or not this will make a difference remains to be seen.

Let’s look at what the Liberal promises for 2015 achieved, to provide some insight into how housing might be affected following the 2019 election:

The mortgage stress test was designed to calm the housing market and slow down runaway price growth. Apparently, this did help in reducing prices in the most out of control markets, but this policy has been criticized for being outdated, making home-ownership impossible for many.

The FTHBI launched on September 2, 2019, to provide a way for homebuyers to have a smaller mortgage and lower payments. It uses a down payment top-up courtesy of the government, covering up to 10 per cent of a home’s price. Although just out of the gate, it will be more appealing to people house-hunting in smaller urban centres as opposed to big cities like Toronto or Vancouver, where 10 percent is a drop in the bucket.

With a minority government, the question is, will all parties be able to play nice? For example, looking at what all parties promised regarding real estate, could efforts be made to work together?

As mentioned, with the Liberals’ plan to improve the First Time Home Buyer Incentive, could they consider the proposal by the Conservatives to extend the first-time maximum mortgage amortization period to 30 years? Could they consider the Conservatives’ suggestions surrounding the stress test? Maybe they could look at the NDP’s plan to build more affordable housing units?

Get rid of the federal sales tax on rental space construction? Would this work with the Liberals’ $55-billion, 10-year National Housing Strategy (NHS) headed up by the Canada Mortgage and Housing Corporation (CMHC)? This also includes building affordable housing with the goal of building as many as 125,000 new units to help more than half a million families be relieved from housing need. The answer is, probably not. But they might try.

It’s only day one following the election, and it really is too early to call how promises, including those surrounding Canadian real estate, will affect us in the months and years to come.

06.11.19 | For Buyers

There is no doubt the pre-construction home has a certain allure to home buyers. Everything is brand new. No one else has ever lived there. You can customize it to create your dream home. But you have to ask yourself if all of these things are maybe a little too good to be true when buying a home. If pre-construction is something you’ve been considering, here’s the 411 to help you decide if it really is for you.

A pre-construction home is a house you buy before it is constructed. You have your choice of homes, including:

For a condo development, you’ll be buying a home off of blueprints or a 3D computer rendering that provides a simulated walkthrough. For houses, you’re usually able to visit a model home that sits on a lot of future development. Although model homes tend to be extremely aspirational in their decor, this is a better way to get a more realistic look at what you’ll be buying.

So, what’s the big attraction of the pre-construction home? There are quite a few benefits, including:

The warranty programs in Canada offer protection for new build homes, including things such as delays in occupancy and closing coverage, protection for your deposit, and the cost of repairs should there be issues in the construction of your home once you move in.

While your home is being built, it is almost guaranteed to rise in value.

Depending on where you’re shopping for your home, bidding wars can really knock up the price. When inventory is low, buyers are desperate, and the more attractive the home and neighbourhood, the more chance there is you could end up paying an inflated price for a resale home. When it comes to pre-construction, you’re looking at a set price. You’ll know exactly how much you’ll be paying, usually at fair market value.

You have the option of designing your home with plenty of upgrades available. You’ve not only got upgrades for things such as kitchen counters and flooring but can also often make structural upgrades including adjusting some floor plan options. Because you’re making all your decisions for changes during the building process, they are far more affordable than a reno or upgrade once you move in. You can make smart decisions that will increase the resale value of your home.

When buying pre-construction condos, the condo fees are lower in new builds than resale condos. That is because everything is new, and the management has yet to see how much it costs to operate the building or property.

Although you tend to need more for a deposit or down payment for pre-construction, the payment is staggered. You have time to keep saving as there is a small amount paid upfront, and then the rest is paid on a schedule that leads up to the final closing.

You’ll have more choices when buying pre-construction compared to resale condos such as the floor of the unit and the location (i.e., a corner unit or a better view).

You’ll have 10 days to “cool off” and reconsider your purchase. During this time, you can arrange for financing and also have a lawyer review the agreement. Should you change your mind or find something in the agreement you don’t like, you can get your full deposit back and walk away.

As with everything, you have to take the bad with the good. Some downsides to pre-construction include:

You should always go into pre-construction with a hint of pessimism. However, with delays, you can be looking at years, not weeks or months. In general, low-rise pre-construction homes tend to see fewer delays than high-rise condos. Researching developers will help you find a trusted company with a good reputation for customer satisfaction.

New builds often don’t come with everything you need. It’s quite common for them to lack essentials like appliances, central air conditioners, indoor window coverings, fencing, decks, and outdoor landscaping. Each of these missing items can be a major added expense that can cost thousands of dollars.

In a new community, you don’t really know what you’re buying into. Who will your neighbours be? What will get built on that vacant land next door? How good will the new school system be? How will these unknowns affect your quality of life and your home’s resale value? It’s OK to take a chance on these unknowns. Just realize that you’re taking a chance.

Although you’ll see lower condo costs going in, you have to prepare yourself to see an increase by as much as 10% to 20% within two years. That is because within two years, the cost of running the condo is realized and increases are always required. This has to be added to your monthly budget when determining if you can afford your new condo, or you might find yourself having trouble making ends meet.

While you do get the opportunity to stagger your deposit payments, you will be paying as much as 10% to 20% overall, compared to a deposit of 5% when signing a resale agreement. In most cases, you’re looking at a 5% sales deposit up front, and then payments that can be set at four, nine and eighteen months, depending on the developer or building schedule.

When buying a resale home, you’ll usually be making your purchase before your locked-in rate expires. However, this can prove to be a challenge for pre-construction homes if the home completion date is extended and passes your locked-in expiry date.

In the case of a pre-construction condo, there is a registration process required before you can legally own your unit. Although you can move into your condo during this period, you’ll be charged a monthly “occupancy fee,” which does not go towards your mortgage. This monthly fee will include your condo fees, the interest portion of the balance owing on the purchase price, and a portion of your property taxes.

Your pre-construction home also has additional fees including GST/HST. There are rebates available if the home is your primary residence depending on your province. If you intend to rent out your unit, you’ll be faced with some taxes that you won’t be too thrilled about. A good way to avoid these taxes is to live in your unit for a while before renting it out.

There are also closing costs that you don’t have when buying a resale home, such as charges for utility meter installations, fees to track your deposit payments, use of the electronic land registration system, and more. These additional fees can add up to as much as 3% on top of your purchase price.

Working with Katherine Barnett Real Estate Team and a lawyer will help you get a more realistic view of what further costs you’ll have to pay on your pre-construction home. Katherine Barnett Real Estate Team can also help you look at a variety of resale and pre-construction options so that you are certain to find your dream home.

04.23.19 | For Sellers

There are plenty of reasons to consider selling your property this Spring. As the sun begins to warm the dormant winter soil and the tulip bulbs are in full bloom, the market is blooming with eager buyers. The housing market always gets busy between the months of April and June. Since winter in most places is too harsh to consider hunting for homes and relocating, early spring is when a lot of buyers finally start looking for a place. You must admit; your home looks its best in the spring. Right?

Spring’s unveiling sets a pretty stage for your home to look its best and draw the attention of potential buyers. Take advantage of the warmer weather to elevate the look of your home’s curb appeal. If you have a yard with flowers and freshly cut green grass, why wouldn’t a buyer fall in love with it! Another reason to list your home this Spring; there are more hours of daylight, meaning potential buyers can view your home more often during the day which in turn increases your chances to land a desirable offer.

Now that all the attention is focused on sunny, longer days, buyers, sellers and real-estate agents emerge from hibernation after a harsh winter. Prospective homebuyers look for fresh new listings to come alive in the Spring market, creating a frenzy between buyers, allowing sellers to keep prices high.

The end of the school year is just around the corner. Buyers with children want to get a head start house hunting for their dream home before a new school year begins. No one wants to disrupt the family routine in the middle of the school year, especially if changing schools is necessary and requires children to leave familiar teachers and friends. Buyers are chomping at the bit to get the closing process started so they can be moved in and settled before the start of a new school year in the fall.