Are you getting ready to buy your first home? If so, you’re probably on a fact-finding mission to help you make the best investment possible. Your first purchase is an exciting time, but there’s so much to do and find out. What kind of home do you want to live in? What neighbourhood? For many people, Burlington has everything you could ever need or want for your first home.

Why Burlington? For starters, it’s frequently rated as one of the best cities in Canada to live in. Burlington is safe, scenic and close to the waterfront. The fabulous annual festivals, events and plethora of dining, shopping and entertainment options give Toronto a run for its money.

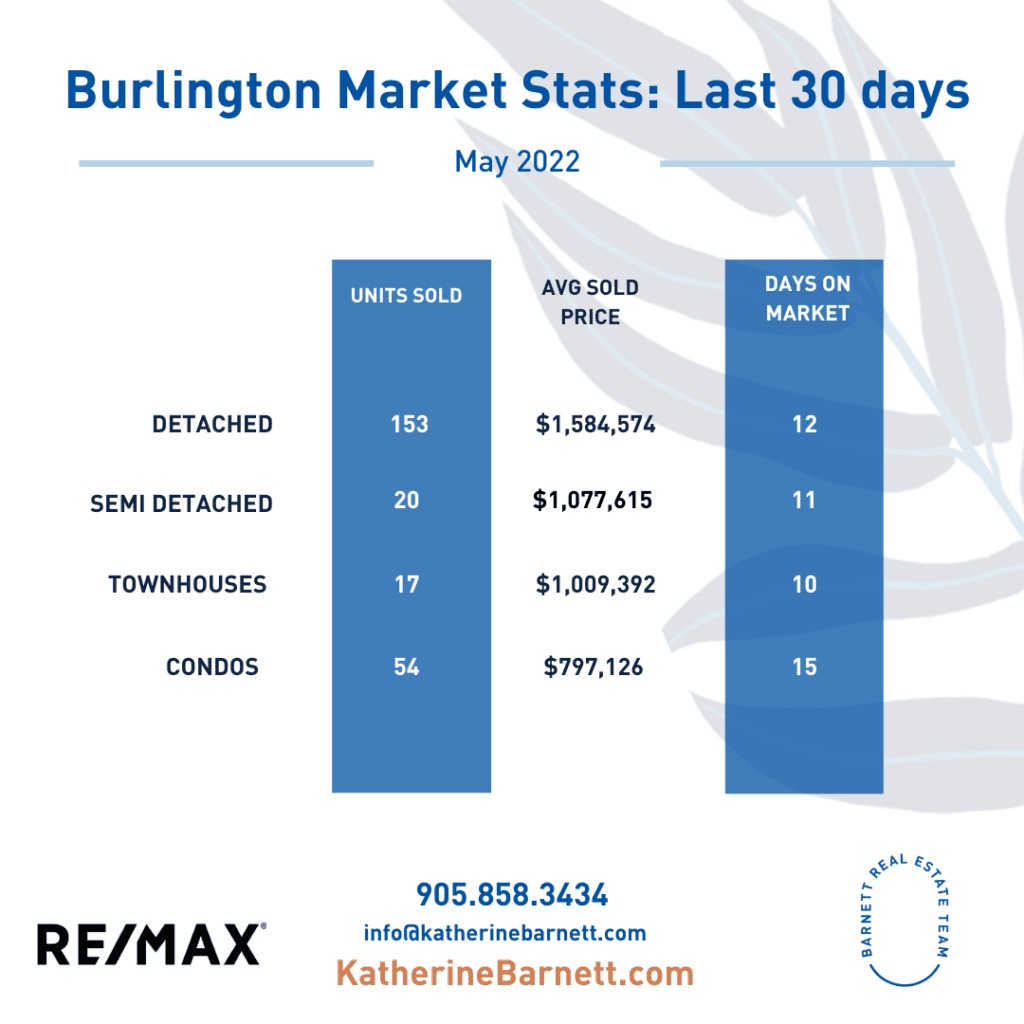

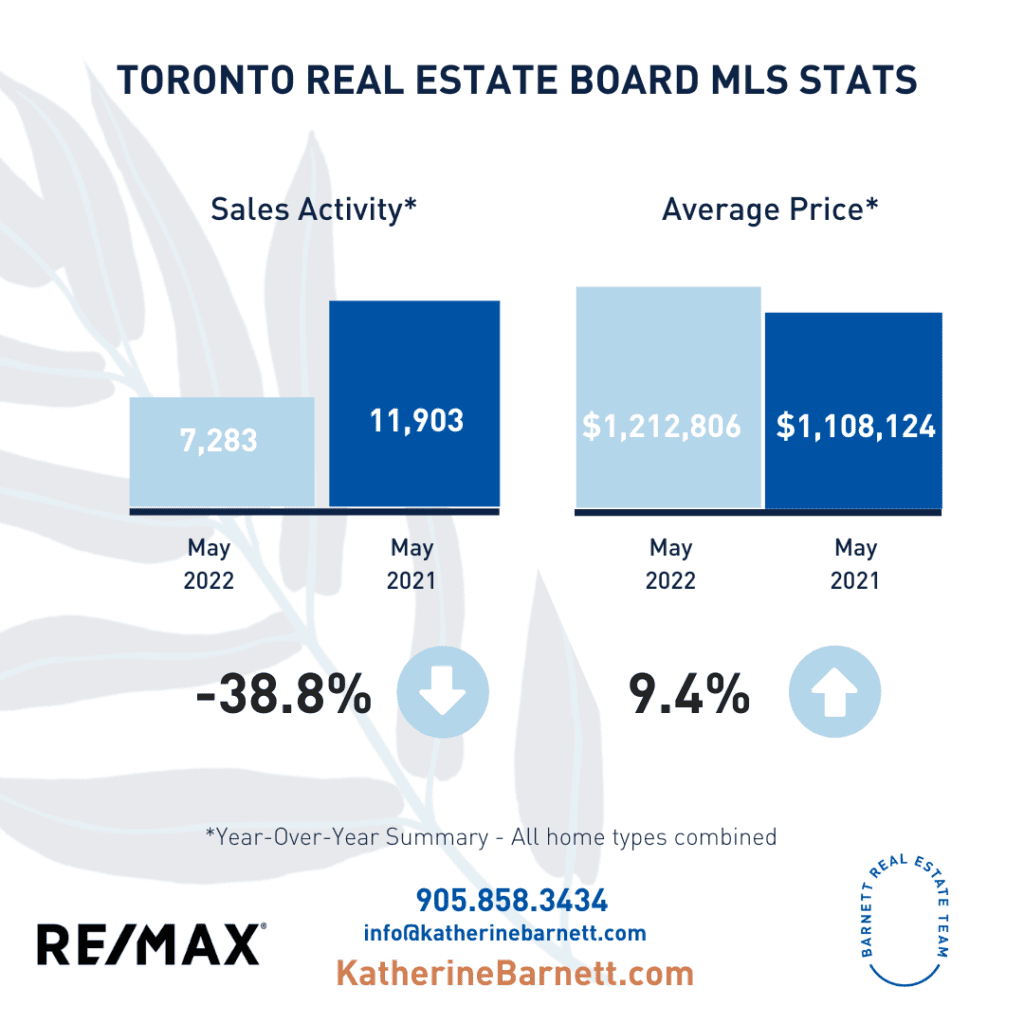

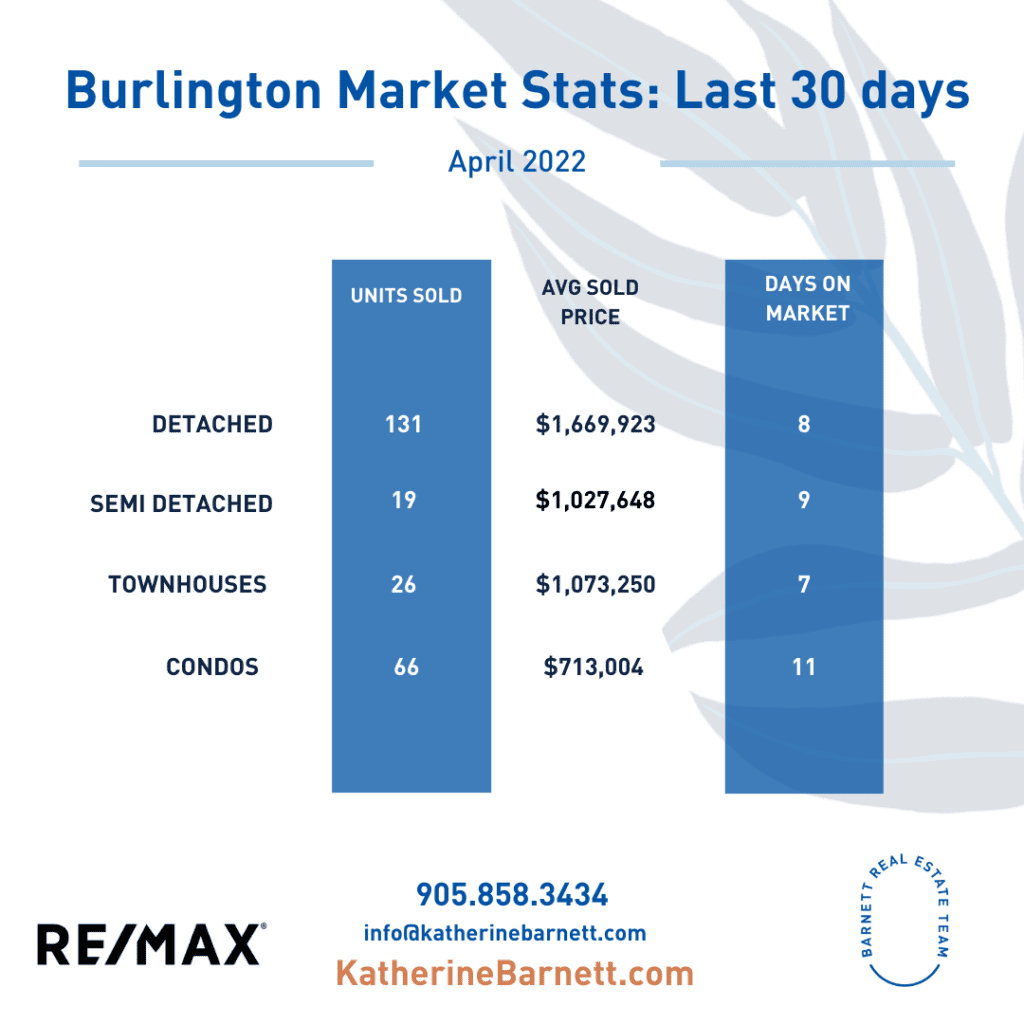

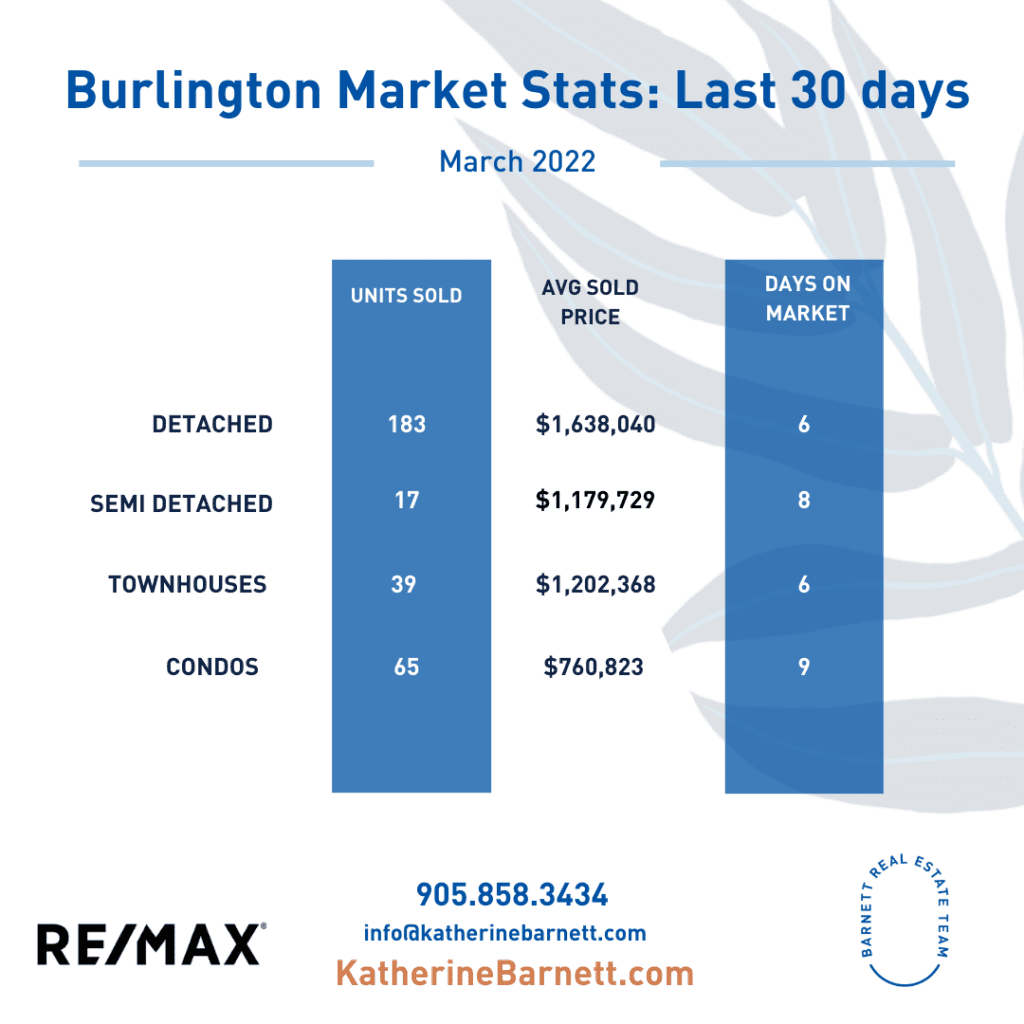

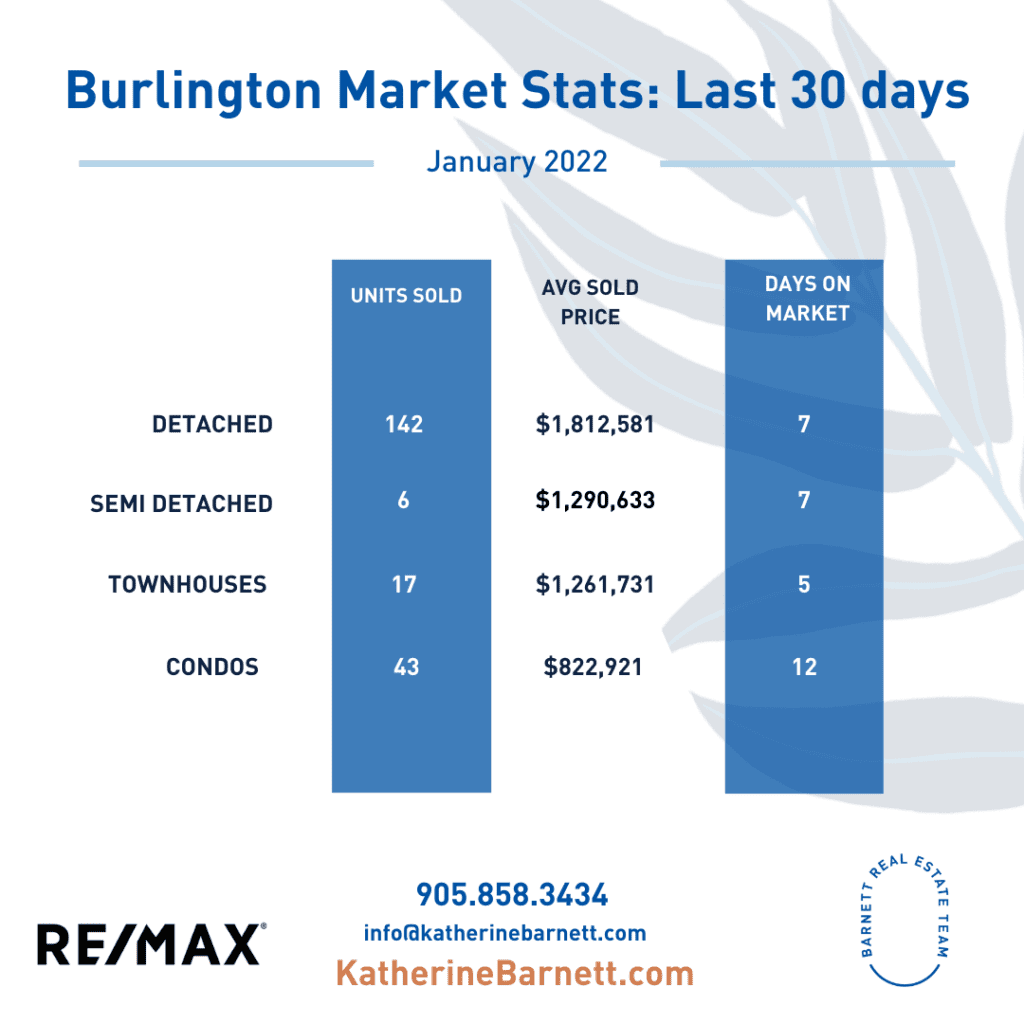

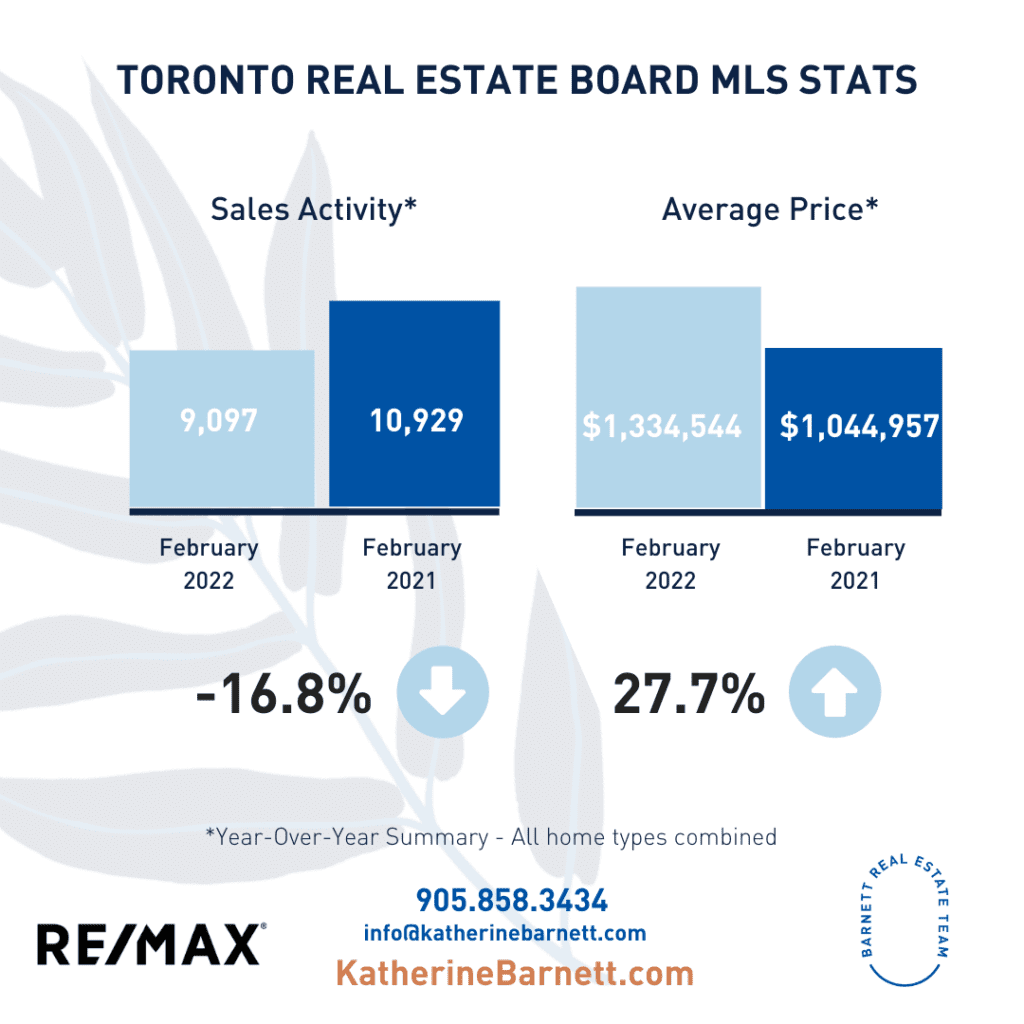

One of the strongest appeals of Burlington is its affordability. Even in this ultra-competitive real estate market, you can often find a starter condo for $500,000 or less. (Although, high-end luxury units are also available, including some beautiful properties right along the waterfront.)

Contrast these prices with Toronto’s average condo unit of $740,000, and it’s easy to see why many new homeowners get their start in Burlington.

To help you on your mission, here is the rundown on some of the top buildings for first-time buyers.

Paradigm Condos

Our very own Maggie Renaud got her start in Paradigm Condos, and she loved every minute of her time there. It is one of the newest facilities in the city, completed in 2018. The building features a beautiful indoor swimming pool, a basketball court and a fitness center. The piece de resistance, however, is the stunning rooftop sky garden and patio. Sit by the fire table, relax and enjoy the spectacular view of the city.

Although Paradigm Condos provides so many amenities that you will rarely have to leave, it is a dream location for anyone who commutes. Go Transit is located just steps away, and there is a path that leads right into the station. Plus, you’ll find many restaurants, coffee shops, and plazas nearby, including Mapleview Mall and Village Square.

Looking for more ideas to help you get into your first home? Here are some ideas to consider:

Maples Condominiums

“The Maples” is a 13 storey building located right in downtown Burlington. It has spacious two-bedroom units ranging from 1420 to 1750 square feet. The larger than average size living space and spectacular rooftop patio come at a surprisingly affordable price, which puts units in this building in very high demand. It is a ten-minute walk from the waterfront, including the gorgeous Spencer Smith Park, where you can spend many hours walking the trails and attending the festivals.

Pinedale Estates

Constructed in 1989, Pinedale Estates is located just east of Appleby Line on Pinedale Avenue. It consists of three buildings with one and two-bedroom units from 700 to 1298 square feet. The building features an indoor pool, a fitness room, a tennis court and a practice driving range, making it a dream home for anyone who loves to stay active. You’re also close to walking trails and parks, including the Burloak Waterfront Park. The Appleby Village Mall is a quick walk away and will take care of all of your shopping needs.

Balmoral Condos

Balmoral has units ranging from 764 square feet to a massive 2200 square feet of luxurious, open concept living. The building offers a party area, fitness centre and hobby room. Located in North Burlington, many of the units offer a beautiful view of the escarpment off of the balcony. Step outside, and you’ll discover many ways to get close to nature, including multiple hiking trails and parks.

It is close to many restaurants and shopping areas and is only a 15-minute drive to the waterfront.

Upper Middle Place

Built in 1978, Upper Middle Place is one of Burlington’s most affordable buildings. The condos are larger than average and range from 980 to 1247 square feet. Many units have been thoroughly upgraded and renovated and offer magnificent views of the escarpment.

The building may be older, but it is very appealing to many young buyers, and not just because of its affordability. The party room, sauna, tennis courts, and outdoor swimming pool make it easy to stay active. There are pubs, restaurants and coffee shops just steps away, and Go Transit is only a 10-minute drive.

Pre-Construction Condos Coming Soon

If your purchase is a couple of years down the road, Burlington has many new condos in the works. Some of these have already started to sell. Here are a couple of the developments that have us really excited!

Martha James Condominiums

Located on James Street in Burlington, units will start from $500,000. Martha James Condos will be close to the waterfront, and all the amenities you could ever need are within easy walking distance. You can visit Spencer Smith Park and many unique shops and cafes within a few blocks of each other.

Once completed, the building will have a fitness centre, a lounge, a bbq area, a rooftop patio and a concierge available in the front lobby.

BeauSoleil Condos

Despite its enviable location right on Lakeshore Road, BeauSoleil Condos will have units starting for less than $500,000. The building will feature an outdoor pool and a beautiful rooftop lounge and dining area, with many amenities a few minutes’ walk away. Step outside, and the beautiful waterfront of Lake Ontario awaits you.

Want to know more about what Burlington has to offer? Here are some more interesting facts to read up on: