After sitting on the sidelines waiting out the market, you have decided on selling your home. You are not alone. This past fall, a NerdWallet study found that a fifth of homeowners plan to sell their homes in the next three years, and 41 percent intend to list their homes in the next five years.

If they plan to follow through on these plans, this could mean an injection of supply in a tight Canadian real estate market, which could help improve the housing affordability situation.

For now, according to the Canadian Real Estate Association (CREA), home prices are up, demand is robust, and mortgage rates look more likely to have peaked at around the five percent mark. At the same time, not all housing markets are created equal.

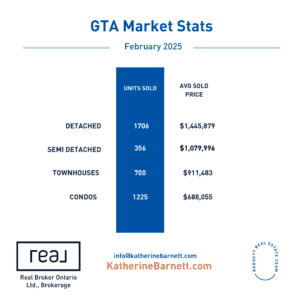

Toronto Housing Market

In the Toronto real estate market, things are gradually inching toward a buyer’s market. In February, association data revealed that home sales plunged more than 27 percent from the previous year. The average selling price also tumbled 2.2 percent to below $1.09 million. The good news for prospective home-buyers? New listings surged 5.4 percent year-over-year, with more than 12,000 units hitting the Toronto real estate market.

With borrowing costs beginning to improve amid the Bank of Canada’s aggressive rate-cutting cycle, affordability should improve. That is if economic worries abate, says Jason Mercer, the chief market analyst at the Toronto Region Real Estate Board.

“On top of lingering affordability concerns, home-buyers have arguably become less confident in the economy,” Mercer said in a recent report. “Uncertainty about our trade relationship with the United States has likely prompted some households to take a wait-and-see attitude towards buying a home. If trade uncertainty is alleviated and borrowing costs continue to trend lower, we could see much stronger home sales activity in the second half of this year.”

Understanding the Real Estate Market When Selling Your Home

Here are nine things to consider when selling your home in today’s real estate market:

Work with Your Real Estate Agent

Some homeowners will make the mistake of going it alone. This is a misstep. Whether buying or selling, having this expert on your side takes the guesswork out of the process. This industry professional understands the current market, knows the neighbourhood well, and comprehends the many facets of the sector’s rules and regulations. Remember, realtors have your best interests at heart, so it is wise to work with one.

Strategic Pricing

Should you strategically price your home or list it at whatever you want? Depending on where you are located, it could be a buyer’s or seller’s market. As a result, it would be prudent to strategically and correctly list your home’s genuine worth. Ultimately, it is about discovering the ideal listing price that strikes a delicate balance of fair market value and attracting buyers.

Here are a few measures you can employ to garner the right price:

- Request a home evaluation to determine your property value compared to the rest of the area’s market conditions.

- Perform a home inspection to ensure everything is ready to showcase.

- Collaborate with your real estate agent on pricing.

Timing Your Listing

Believe it or not, even in today’s housing market, it is crucial to list your home at the right time. While it is not always possible, industry experts say it should be prioritized. Why? You want to sell when prospective home-buyers want to acquire a property.

Here are a few things you need to know:

- Winter is usually the slowest time of the year, particularly around the holidays.

- People are typically ready to purchase a home when it is warmer outside.

- Selecting the best day of the week can offer a competitive edge.

- Your real estate agent’s online and offline marketing strategy will also consider the timing of your listing.

It is also worth recommending that you be flexible with your showing times. If interested individuals are appearing after work rather than in the middle of the day, then it is an indication that you might need to be more accommodating to bolster the odds of a sale.

Check Emotion at the Door

Do you think your home is worth much more than what is being listed? Do you think it will be hard to part ways with the keys to your house that you saw your children grow up in? Would you reject a request from the home-buyer to toss in a new refrigerator?

Whatever the case may be, experts recommend checking your emotions at the door and making intelligent decisions. Remember, your objective in selling your home is to sell it fast and garner the best price possible.

Declutter

Decluttering your home can be a herculean endeavour as we accumulate a lot of stuff over the years. However, it is a vital task that should be done to allow potential home-buyers to examine the space through their lenses. By having open space, you can also maximize the square footage rather than keeping everything cramped with chests, sofas, boxes, and a whole host of other items that take up space.

Staging the Right Way

Staging is a critical tool in your selling arsenal. You want to present your home in the best possible light. Even if your home is crammed with so much stuff, you should try to remove many of these things and stage your living room, bedrooms, or kitchens so that they are attractive to buyers.

Here are several tips:

- Conduct a deep cleaning of your entire home.

- Stage your home to appeal to buyers rather than gorgeous furniture pieces (a single-family home will appeal to families, while a bachelor condominium suite will appeal to single professionals).

- Improve your curb appeal by mowing the lawn, installing a neat street number sign, changing the light bulbs, and organizing the yard.

- Snap high-quality photos of your home because many buyers will be performing their search online, meaning they will explore virtual tours, floor plans, and still images.

Yes, during the coronavirus pandemic, the buying frenzy meant anything goes, and buyers were indifferent to the conventional approaches to purchasing a property. Conditions have stabilized, and now it is best to utilize traditional methods in the real estate market.

Repairing Major and Minor Problems

From a leaky roof to a leaky faucet, sellers should be responsible enough to help repair major and minor problems throughout your house – inside and outside. By doing this, you can maximize your listing price rather than having to haggle with a buyer about having to repair or replace something. Additionally, home-buyers will request inspections anyway (they have made a comeback in the post-pandemic market!), so these professionals will inevitably find out sooner or later.

Expect Smart Buyers

If you approached buying your first (or second) home with thoughtfulness and strategy, why wouldn’t the person buying your home do the same? In today’s digital age—where expert advice is just a few clicks away—it’s reasonable to assume that everyone walking through your kitchen and inspecting your bathroom is coming in well-informed. The current housing market demands savvy from both buyers and sellers.

Ultimately, most prospective buyers are armed with a wealth of knowledge. Whether they’re using real estate apps or working with a skilled agent, you can expect sharp, well-prepared individuals stepping through your front door.

Finalize the Sale

After both sides of the transaction have agreed to the terms, it is time to sign a purchase agreement. Your attorney or a notary will have likely performed the legal aspects. The title is clear, the required documents have been filled, and the paperwork officials transfer ownership from you to the buyer. When closing day arrives (yay!), the buyer will visit the attorney’s office to finish the paperwork and offer the funds. At this stage, the transaction is complete, keys are exchanged, and proceeds from the sale will be distributed.

Source: RE/MAX