Rising housing prices and inflation are causing financial challenges for many Canadians. Very few people are feeling the sting more than those aspiring to buy their first house. Lately, it seems that only those who enjoy very high incomes or have help from relatives can afford a place of their own.

In light of the many challenges first-time buyers face, the Federal government introduced a piece of legislation called the “First Home Buyer Incentive.”

This program took effect in September 2019 as the average cost of housing prices began their steady, upward climb. On paper, the incentive might look like a dream come true for those struggling to buy a house, but there are some downsides to be aware of.

Buying a home can be intimating, especially if it’s your first time. Here are some other resources that can help:

Here’s everything you need to know:

The First Time Home Buyer Incentive – How it Works

If you qualify, the government puts up to 5% of the down payment on a resale house or 10% on a newly constructed project. This incentive is designed to help in two ways:

- It makes it easier to afford the downpayment

- With a larger down payment, your monthly mortgage payments are more affordable

Can the First Time Home Buyer Incentive help someone who couldn’t otherwise afford a home? In some cases, yes. However, it’s important to know that this isn’t free money. The program is similar to a second mortgage, except no monthly payments are due.

What Are the Downsides to the Program?

You Will Have to Repay – and Then Some…

When you sign up for the program, the government basically becomes a co-owner of your property. Any funds received through the program must be repaid either when you sell the property or within 25 years. What does that mean when buying and selling?

Let’s imagine you bought a condo for $480,000 in 2019. It was a new build, so the government gave you 10%, or $48,0000 upfront, for your down payment. Now, in 2022, you want to sell the condo, which has risen in value to $900,000. Upon closing, it’s time to pay back the incentive. However, it’s not a standard loan where you pay back the principle plus interest. The government has a stake in your property for 10% of the resale price. In this case, because the value has risen to $900,000, you’re on the hook for $90,000!

It’s Too Little, Too Late…

In 2019, the incentive may have helped some first-time buyers. Now, housing prices have soared, and it’s almost impossible to qualify. To be considered, you must:

- Be a first-time buyer

- Have a combined household income of less than $120,000

Even if you meet these requirements, the mortgage is capped at a maximum of four times your annual household income. If you earn $100,000, your mortgage must be $400,000 or less to qualify for the program.

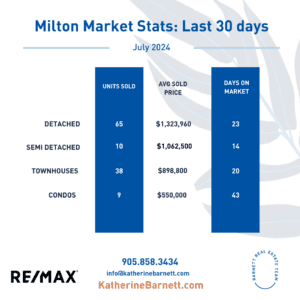

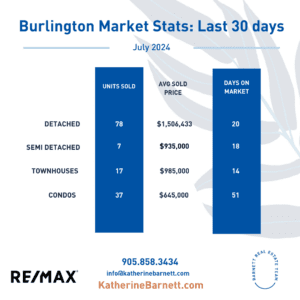

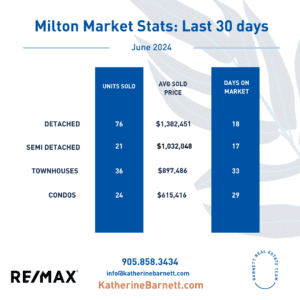

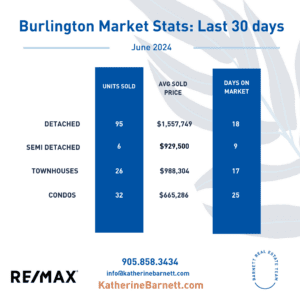

In 2022, the average house price in Burlington or Milton stands at around $1.3 million. Unless you have a massive downpayment available, a mortgage capped at $400,000 isn’t helpful for most people.

Is the First Time Buyer Incentive even worth it? Only you can decide. However, there are other programs designed to help you that don’t give the government such a significant stake in your property.

Want more help getting into the market as a first-time buyer? Our comprehensive Buyer’s Guide can help. You can download it for free here.

The Canada Home Buyer’s Plan

This program allows you to withdraw up to $35,000 from an RRSP without tax penalty as a down payment toward your first house. Here’s what you need to qualify:

- You must be a first-time buyer or buying on behalf of someone with a disability

- You must be a resident of Canada

- You must use the funds to buy property

- Within one year of buying or building the home, it must be your primary residence

First Time Home Buyer Tax Credit

As a first-time buyer, you can claim up to $5000 on your tax return, which results in a $750 reduction in taxes. It may not seem like a lot of money, but it can go a long way toward your moving costs, legal fees or utility hookups.

Land Transfer Rebate

Whenever you buy property, the land transfer tax is one of the closing costs you must factor in. It can amount to several thousands of dollars which can not be rolled into your mortgage.

However, in Ontario, you can apply for a rebate of the provincial portion, resulting in a savings of up to $4,000.

To buy your first home, you’ll need some creativity and perseverance. Knowledge of how government incentive programs work can go a long way.

Did you know that we offer a monthly webinar dedicated to helping first-time buyers? You can sign up for free right here.