August 2025– GTA Housing Market News

Here is our quick market update!

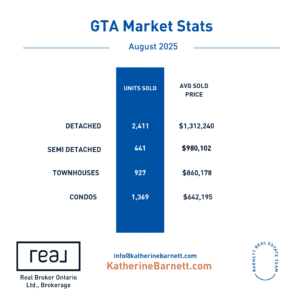

📊 GTA Housing Market Update – August 2025

Sales Rise Modestly, Buyers Benefit from More Choice

The Greater Toronto Area housing market saw a year-over-year increase in sales this August, alongside an even greater jump in new listings. With more inventory across all market segments, buyers continued to enjoy increased negotiating power, keeping average selling prices under pressure.

“Compared to last summer, sales have improved modestly. With inflation under control and the economy slowing, further Bank of Canada rate cuts could help offset the impact of tariffs,” said TRREB President Elechia Barry-Sproule.

“Greater affordability would not only support more home sales but also deliver significant economic spin-off benefits.”

📌 August 2025 Market Highlights

-

5,211 home sales

🔺 Up 2.3% vs. August 2024 -

14,038 new listings

🔺 Up 9.4% year-over-year -

Average selling price: $1,022,143

🔻 Down 5.2% year-over-year -

MLS® HPI Composite Benchmark:

🔻 Down 5.2% year-over-year

📉 On a seasonally adjusted basis, sales dipped slightly from July, while new listings increased. This reinforced a well-supplied market where buyers continue to hold negotiating leverage.

💬 Expert Insights

“Even with lower borrowing costs and prices, many GTA households earning an average income still find it challenging to carry a mortgage on an average-priced home,” said Jason Mercer, TRREB’s Chief Information Officer.

“Further rate cuts could bring more buyers off the sidelines, especially given today’s elevated level of supply.”

Looking beyond the immediate market, TRREB CEO John DiMichele emphasized the importance of linking housing to broader economic policy:

“Large-scale infrastructure projects—like affordable housing, public transit, ports, and shipbuilding—are essential for Canada’s long-term economic sustainability. But in the short term, spurring housing activity can play a leading role in recovery, just as it has in past cycles.”

🏠 What This Means for Buyers & Sellers

-

Buyers: More listings mean more options, stronger negotiating power, and the potential for better deals—especially if borrowing costs ease further in the months ahead.

-

Sellers: While prices remain under pressure, well-priced homes continue to attract interest, particularly in sought-after neighbourhoods.

All in all, it’s a market that favors buyers, but things can still move fast if the property hits the right price point. If you’re curious about what all this means for your home or area specifically, feel free to get in touch — we’re always happy to help.

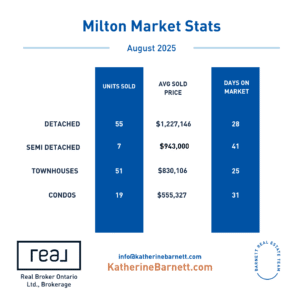

Milton Real Estate Market

The average price in Milton $964,086

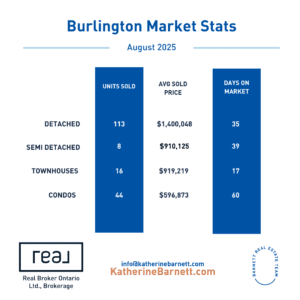

Burlington Real Estate Market

The average price in Burlington $1,159,791

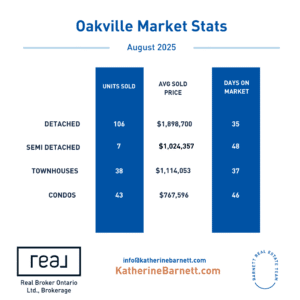

Oakville Real Estate Market

The average price in Oakville $1,415,357

Have questions about the market? Contact us today to learn more!

Previous Reports on GTA Housing Market News