December 2025– GTA Housing Market News

Here is our quick market update!

🏡 GTA Housing Market Update – December & Year-End 2025

Affordability Improves as Market Prepares for Recovery

Home sales across the Greater Toronto Area (GTA) declined in 2025 compared to 2024, as economic uncertainty continued to weigh on consumer confidence. At the same time, elevated listing inventory throughout the year gave buyers more choice and negotiating power—resulting in lower selling prices and improved overall affordability.

“The GTA housing market became more affordable in 2025 as both selling prices and mortgage rates trended lower,” said TRREB President Daniel Steinfeld.

“This improvement has laid the groundwork for recovery. Once households feel confident that the economy and labour market are on solid footing, pent-up demand will begin to translate into increased home sales.”

📊 2025 Year-End Market Snapshot

-

62,433 total home sales

🔻 Down 11.2% from 2024 -

186,753 new listings

🔺 Up 10.1% year-over-year -

Average selling price (2025): $1,067,968

🔻 Down 4.7% from 2024

Higher inventory levels throughout the year helped shift the market toward better balance, creating improved affordability conditions for buyers heading into 2026.

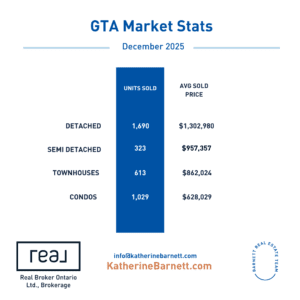

📅 December 2025 Market Highlights

-

3,697 home sales

🔻 Down 8.9% vs. December 2024 -

5,299 new listings

🔺 Up 1.8% year-over-year -

Average selling price: $1,006,735

🔻 Down 5.1% vs. December 2024 -

MLS® HPI Composite Benchmark:

🔻 Down 6.3% year-over-year

On a seasonally adjusted basis, sales dipped slightly from November while new listings increased. The MLS® HPI edged lower month-over-month, while the average selling price rose modestly—reflecting ongoing price stability near year-end.

💬 Expert Outlook for 2026

“Stronger trade certainty and major domestic infrastructure investments will be key to improving housing activity,” said TRREB Chief Information Officer Jason Mercer.

“Even with better affordability, households need confidence in their employment outlook before committing to long-term mortgage payments.”

TRREB CEO John DiMichele emphasized the role of government policy in restoring confidence and easing cost pressures:

“Governments at all levels must act now to provide meaningful tax relief and address the rising cost of living,” DiMichele said.

“Families need financial breathing room to afford housing and meet everyday expenses. Fair, responsible tax policies can help rebuild trust, restore confidence, and support a more stable and inclusive economy.”

🏠 The Bottom Line

2025 was a year of adjustment and improving affordability for the GTA housing market. While uncertainty held back sales, lower prices, easing borrowing costs, and strong inventory levels have positioned the market for a potential rebound—once economic confidence strengthens.

As we head into 2026, buyers and sellers alike will be watching closely for signs of stability, policy action, and renewed momentum.

All in all, it’s a market that favors buyers, but things can still move fast if the property hits the right price point. If you’re curious about what all this means for your home or area specifically, feel free to get in touch — we’re always happy to help.

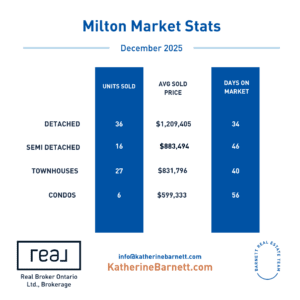

Milton Real Estate Market

The average price in Milton $973,454

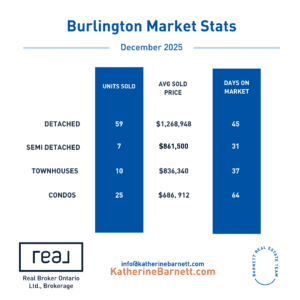

Burlington Real Estate Market

The average price in Burlington $995,162

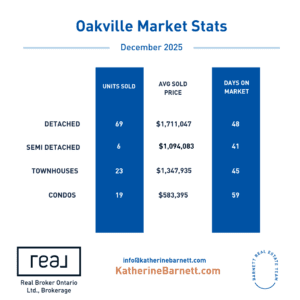

Oakville Real Estate Market

The average price in Oakville $1,344,131