November 2025– GTA Housing Market News

Here is our quick market update!

🏡 GTA Housing Market Update – November 2025

Cautious Buyers, Softer Prices, and Signs of Renewed Economic Optimism

The Greater Toronto Area (GTA) housing market saw slower activity in November, with home sales, new listings, and selling prices all trending below last year’s levels. While borrowing costs and pricing remain attractive for many would-be buyers, continued economic uncertainty kept a significant number on the sidelines.

“Many GTA households are eager to take advantage of lower rates and more favourable prices,” said TRREB President Elechia Barry-Sproule.

“What they need most now is confidence in their long-term employment outlook. Encouraging job and economic news in November is a promising step—if the momentum continues, we may see stronger homebuyer confidence heading into 2026.”

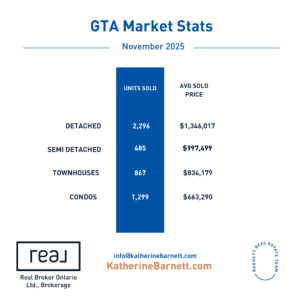

📊 November 2025 Market Snapshot

-

5,010 home sales

🔻 Down 15.8% vs. November 2024 -

11,134 new listings

🔻 Down 4% year-over-year -

Average selling price: $1,039,458

🔻 Down 6.4% year-over-year -

MLS® HPI Composite benchmark:

🔻 Down 5.8% year-over-year

Month-over-month, both sales and new listings dipped slightly on a seasonally adjusted basis. Price trends held steady, with the MLS® HPI edging down and the average selling price ticking up marginally from October.

💬 Experts Share Market Insights

Despite uncertainty earlier in the fall, November’s economic data offered some positive surprises.

“November’s employment and GDP numbers outperformed expectations,” noted Jason Mercer, TRREB’s Chief Information Officer.

“The Canadian economy appears to be withstanding trade-related pressures better than anticipated. More stability on the trade front, combined with the boost from major infrastructure investments, could help restore homebuyer confidence moving forward.”

🏗️ Housing Supply: The Long-Term Challenge

A well-supplied resale market continues to give buyers breathing room—but sustaining that balance requires continued new construction.

“As resale inventory gets absorbed, we need new housing to fill the pipeline,” said TRREB CEO John DiMichele.

“Ontario needs more options between condo apartments and traditional single-family homes—missing middle housing that supports families and affordability. Construction activity also drives major economic benefits, which are especially valuable in today’s climate. All three levels of government must step up with incentives that help get more homes built.”

🏠 What This Means for Buyers & Sellers

For Buyers:

-

Affordability remains better than in recent years

-

Choice is strong across most segments

-

Improving economic signals may strengthen confidence heading into 2026

For Sellers:

-

Pricing competitively is crucial in today’s buyer-leaning market

-

Well-prepared listings continue to attract motivated, serious buyers

Bottom Line

November brought cooler market activity but warmer economic signals. As job growth stabilizes and major infrastructure projects roll out, confidence may rise—setting the stage for a more active 2026 housing market.

All in all, it’s a market that favors buyers, but things can still move fast if the property hits the right price point. If you’re curious about what all this means for your home or area specifically, feel free to get in touch — we’re always happy to help.

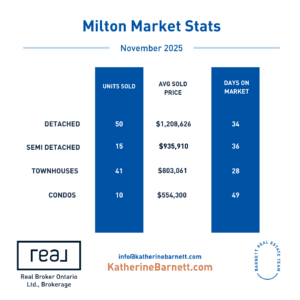

Milton Real Estate Market

The average price in Milton $964,583

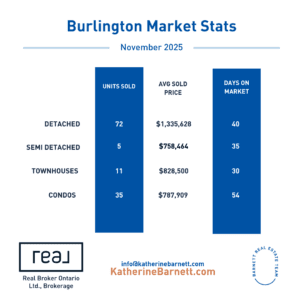

Burlington Real Estate Market

The average price in Burlington $1,050,257

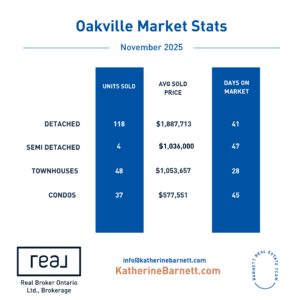

Oakville Real Estate Market

The average price in Oakville $1,389,725

Have questions about the market? Contact us today to learn more!

Previous Reports on GTA Housing Market News