October 2025– GTA Housing Market News

Here is our quick market update!

🏡 GTA Housing Market Update – October 2025

Buyer-Friendly Conditions Continue Amid Economic Uncertainty

The Greater Toronto Area (GTA) housing market remained tilted in favour of buyers in October, as home sales declined year-over-year while new listings edged higher. With lower borrowing costs and increased inventory, motivated buyers were able to negotiate more favourable prices across many market segments.

“Those who feel confident about their job stability and long-term financial outlook are benefiting from improved affordability,” said TRREB President Elechia Barry-Sproule.

“However, uncertainty about the broader economy continues to keep some would-be buyers on the sidelines.”

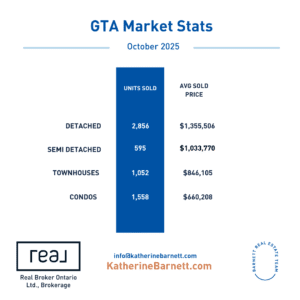

📊 October 2025 Market Highlights

-

6,138 home sales

🔻 Down 9.5% vs. October 2024 -

16,069 new listings

🔺 Up 2.7% year-over-year -

Average selling price: $1,054,372

🔻 Down 7.2% year-over-year -

MLS® Home Price Index Composite Benchmark:

🔻 Down 5.0% year-over-year

On a seasonally adjusted basis, both home sales and new listings declined slightly month-over-month. Price trends remained stable overall, with the MLS® Home Price Index largely flat and the average selling price showing a modest monthly dip.

💬 Insights from TRREB Experts

“Monthly mortgage payments for an average-priced GTA home have continued to trend lower,” said Jason Mercer, TRREB’s Chief Information Officer.

“This is being driven by both reduced borrowing costs and softer prices—making ownership more attainable for many households. Once confidence returns around trade relations with the U.S. and China, we expect home sales to pick up.”

🏗️ Building Confidence Through Housing Investment

Beyond short-term market movements, TRREB CEO John DiMichele emphasized the critical role of housing in driving economic growth and community resilience:

“Housing is essential economic infrastructure,” DiMichele noted.

“As our population grows, we need innovation and private investment to accelerate construction across all housing types. Governments can support this by modernizing tax rules, reducing buyer costs, and eliminating exclusionary zoning. Rebuilding market confidence today means creating jobs and delivering the homes Ontarians urgently need.”

🏠 Takeaway for Buyers and Sellers

-

For Buyers: Lower prices and borrowing costs have improved affordability, making it a strong environment for those ready to purchase with long-term confidence.

-

For Sellers: While price competition remains, serious buyers are active—especially for well-priced, move-in-ready homes.

Bottom Line:

With affordability steadily improving and interest rates easing, the GTA market is poised for renewed activity once economic uncertainty subsides. Buyers who act strategically in today’s market may find meaningful long-term value.

All in all, it’s a market that favors buyers, but things can still move fast if the property hits the right price point. If you’re curious about what all this means for your home or area specifically, feel free to get in touch — we’re always happy to help.

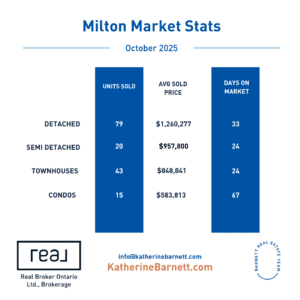

Milton Real Estate Market

The average price in Milton $1,026,445

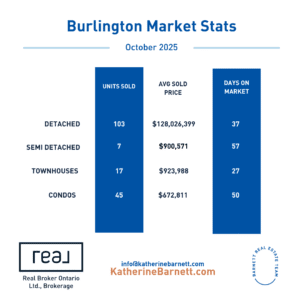

Burlington Real Estate Market

The average price in Burlington $991,062

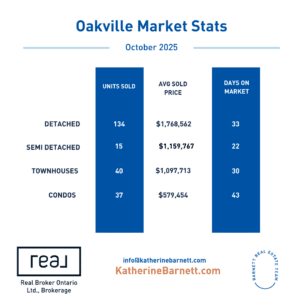

Oakville Real Estate Market

The average price in Oakville $1,361,258

Have questions about the market? Contact us today to learn more!

Previous Reports on GTA Housing Market News