September 2025– GTA Housing Market News

Here is our quick market update!

🏡 GTA Housing Market Update – September 2025

Rate Cut Boosts Buyer Confidence as Sales Rise Year-Over-Year

The Greater Toronto Area (GTA) housing market saw a healthy increase in sales this September compared to a year ago, as more buyers took advantage of improved affordability and lower monthly mortgage payments. With abundant inventory across the region, buyers continued to negotiate on price, keeping average selling values slightly lower than last year.

“The Bank of Canada’s September rate cut was welcome news for homebuyers,” said TRREB President Elechia Barry-Sproule.

“Lower borrowing costs are allowing more households to afford homes that meet their needs. Rising sales will also help stimulate the broader economy through increased housing-related spending—offsetting some of the ongoing challenges tied to trade uncertainty.”

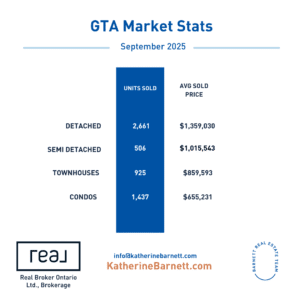

📊 September 2025 Market Highlights

-

5,592 home sales

🔺 Up 8.5% year-over-year -

19,260 new listings

🔺 Up 4% year-over-year -

Average selling price: $1,059,377

🔻 Down 4.7% vs. September 2024 -

MLS® HPI Composite Benchmark:

🔻 Down 5.5% year-over-year

On a seasonally adjusted basis, home sales rose month-over-month compared to August 2025, while new listings declined. This shift suggests a slight tightening in some market segments as buyers absorbed more available supply.

💬 Market Insight from TRREB Experts

“While sales activity has improved notably over the past year, it still sits below long-term norms when measured against the size of the GTA’s household base,” said TRREB Chief Information Officer Jason Mercer.

“Two additional quarter-point rate cuts by the Bank of Canada would bring monthly mortgage payments more in line with average household incomes, further encouraging buyer activity and supporting broader economic growth.”

🏠 What This Means for Buyers and Sellers

-

For Buyers: Lower interest rates and steady prices present renewed opportunities to enter the market with more affordable monthly payments.

-

For Sellers: Market conditions are gradually tightening, which may support stability in selling prices heading into the fall season.

The Bottom Line:

With improving affordability, easing borrowing costs, and a balanced supply of homes, the GTA housing market is showing early signs of renewed confidence heading into the final quarter of 2025.

All in all, it’s a market that favors buyers, but things can still move fast if the property hits the right price point. If you’re curious about what all this means for your home or area specifically, feel free to get in touch — we’re always happy to help.

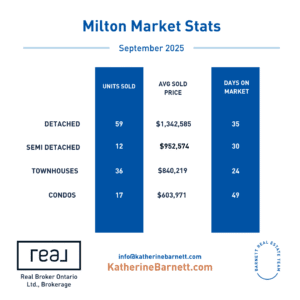

Milton Real Estate Market

The average price in Milton $1,036,162

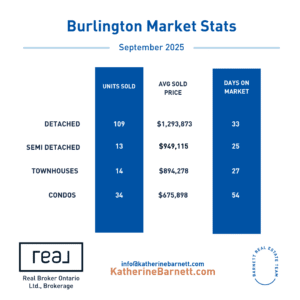

Burlington Real Estate Market

The average price in Burlington $1,063,970

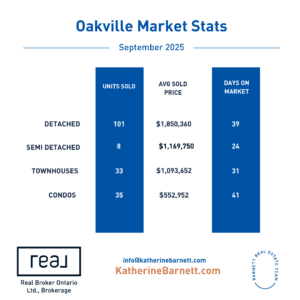

Oakville Real Estate Market

The average price in Oakville $1,399,948

Have questions about the market? Contact us today to learn more!

Previous Reports on GTA Housing Market News