It can be a humbling experience for first-time homebuyers in today’s Canadian real estate market. Whether putting together sizeable down payments or navigating the challenging mortgage market, first-time homebuyers have many hurdles to overcome.

That said, despite what could be a daunting endeavour for many households, it is also an exciting time because you are making a decision that will impact the rest of your life. It might sound like a trope these days, but acquiring a single-family home, condo, or townhome is the most significant purchasing decision you will ever make. As a result, making the right decisions and doing your due diligence is imperative to ensure you are confident, prepared, and knowledgeable in this journey.

So, what should you know about the Canadian housing market as a first-time homebuyer?

Understanding the Real Estate Market as a First-Time Home Buyer

Here are seven aspects of the real estate market every first-time homebuyer needs to know:

Aim for What You Can Afford

Financial preparation is a critical first step in the homebuying process. In the early days of the pandemic, many households threw caution to the wind amid a climate of historically low rates.

Today, with mortgage rates averaging six percent and inflation still affecting household budgets, it is vital to manufacture a realistic homebuying budget and stay within your means no matter how large a mortgage you might be offered. To achieve this, you will have to crunch the numbers for everything: income, savings, and debts.

As a new buyer, you do not want to decimate your budget. When purchasing a residential property, you should consider other expenses than your mortgage. These include property taxes, homeowners’ insurance, and property maintenance and repair costs.

Mortgage Pre-Approval

As a first-time buyer, getting pre-approved for a mortgage is a prudent way to know how much lenders will allow you to borrow. However, even if you qualify for more than expected, ensure you can still afford the monthly payments. Remember that most properties require a minimum down payment of at least five percent. Of course, the bigger your downpayment, the less your overall debt will be.

Knowing Various Mortgages

Industry experts purport that understanding the different types of mortgages available is crucial to understanding the terms and conditions. This can also help you decide whether to choose a fixed- or variable-rate mortgage.

Fixed-rate mortgages are those where the interest rate remains the same throughout the term of your mortgage. A variable-rate mortgage is one where the interest changes. Mortgages can also have different term lengths ranging from six months to ten years. A longer mortgage term can help you lower your monthly payments, but shorter terms can score you a better interest rate.

As a first-time buyer, it is natural for you to want the best: the property size, location, or features and amenities. But it is best to be realistic and practical. It is not always possible to get what one wants every time. You may have to be flexible and compromise on certain aspects of your first home. This is especially true for people who are working on a tight budget. Hence, don’t aim too high or too low. Just be realistic and find a property that meets your most essential criteria and aligns with your current lifestyle.

Select Your Home

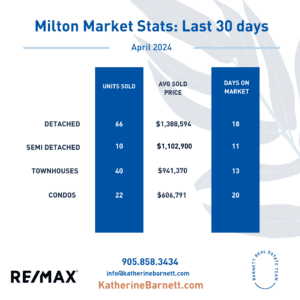

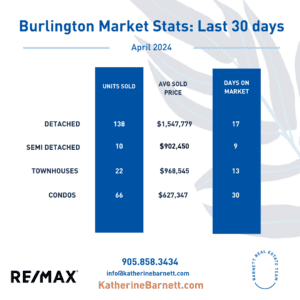

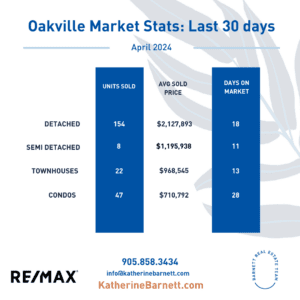

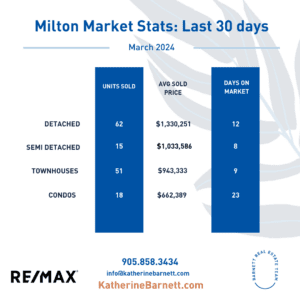

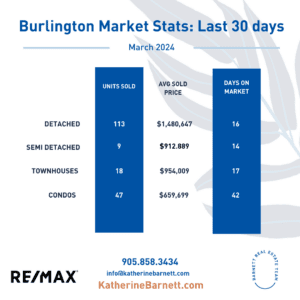

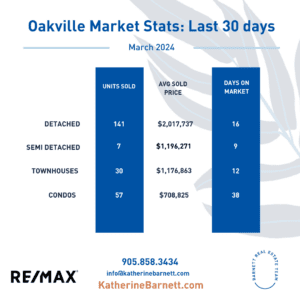

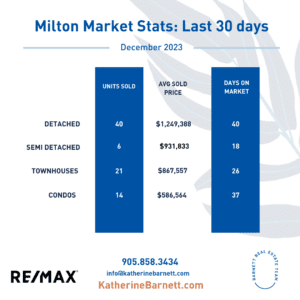

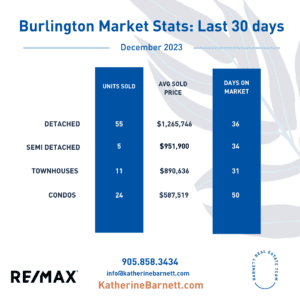

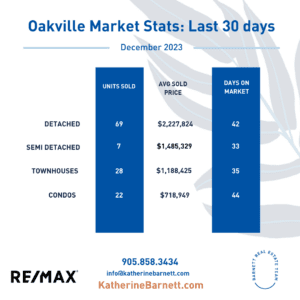

What type of home do you desire? Indeed, there are various categories of residential properties:

- Single-family homes

- Semi-detached houses

- Townhomes

- Condominiums

Different property types have different benefits and challenges.

For example, condos usually have many amenities but high monthly condo fees and special assessments. Detached homes offer more privacy but may be more expensive to buy and maintain.

Therefore, determining what type of home you want based on your budget, lifestyle, and long-term goals might be much more complex than you would imagine.

Research, Research, Research

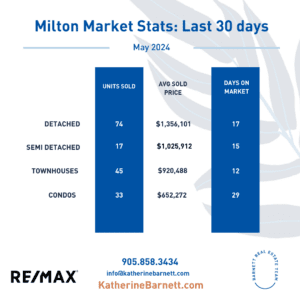

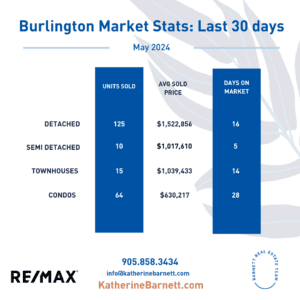

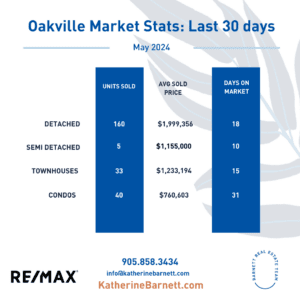

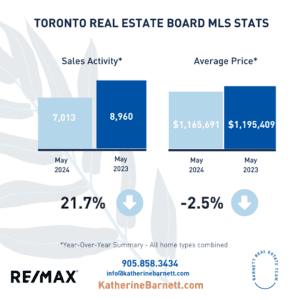

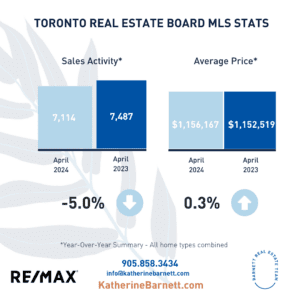

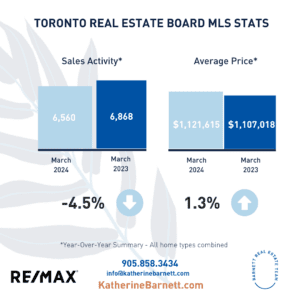

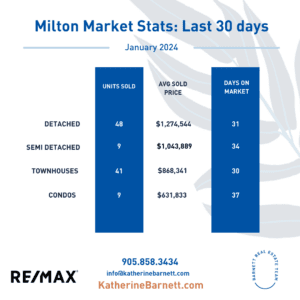

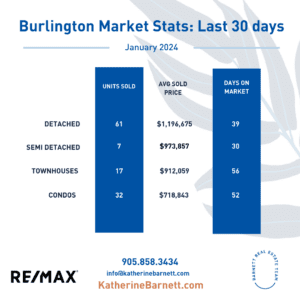

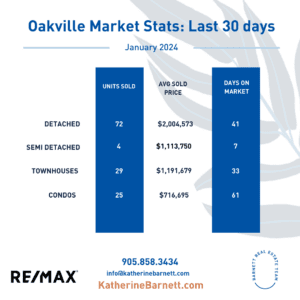

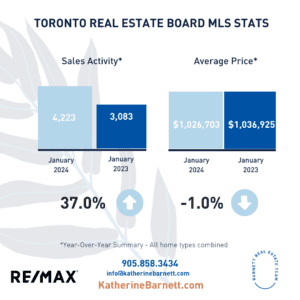

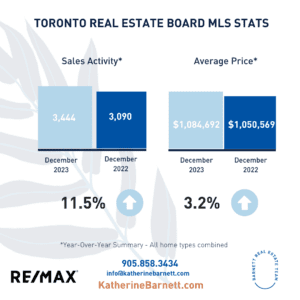

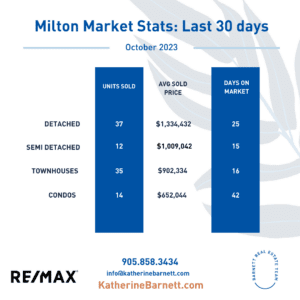

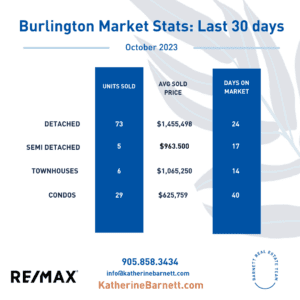

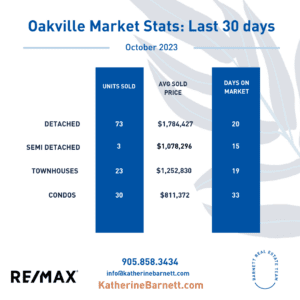

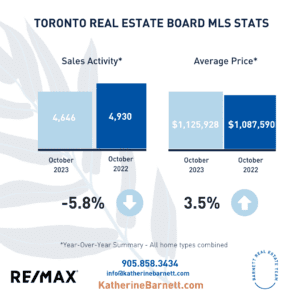

Since this is your first time buying a home, you should research the national, provincial, or local real estate market comprehensively. This would typically consist of identifying the few locations that appeal to you the most and studying the property values and market trends in those areas.

You can understand pricing in those places by learning about local market conditions.

Find a Good Real Estate Agent

A real estate agent can be a lifesaver in many ways. Let’s be honest: as a new buyer, you cannot understand the dynamics of the real estate market as efficiently as a real estate agent would. With the Barnett Real Estate Team we believe that finding your ideal home should be an enjoyable experience. That’s why we focus on taking the stress out of your purchase. With us, no detail is overlooked. Our in-depth local knowledge and perfected buying process make your purchase seamless, successful, and fun! If we work together, you can truly relax—and focus on choosing a home that suits you perfectly.

The Home Inspection

Remember when it was reported that homebuyers were skipping home inspections during the pandemic-era real estate market? Crazy times! Now that conditions have stabilized, it is imperative to follow through on an industry custom: Getting a home inspection.

Sure, many novice homebuyers may not realize the importance of this step because they have never purchased a property before. However, inspecting a property you are considering buying can help identify potential problems. It might be tempting to skip this step, but do not make this mistake. The amount you spend today to inspect the property may save you a lot more in the long run.