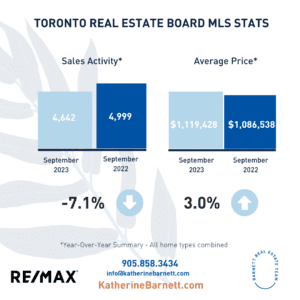

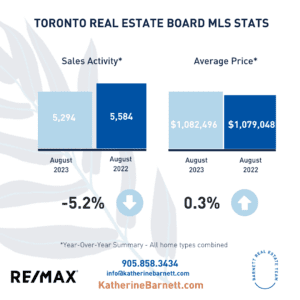

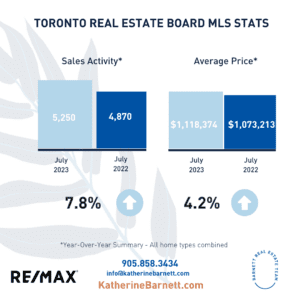

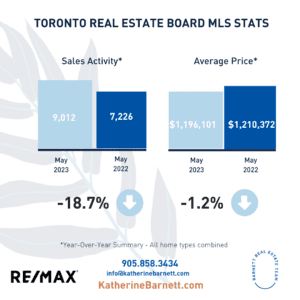

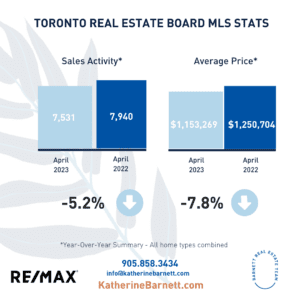

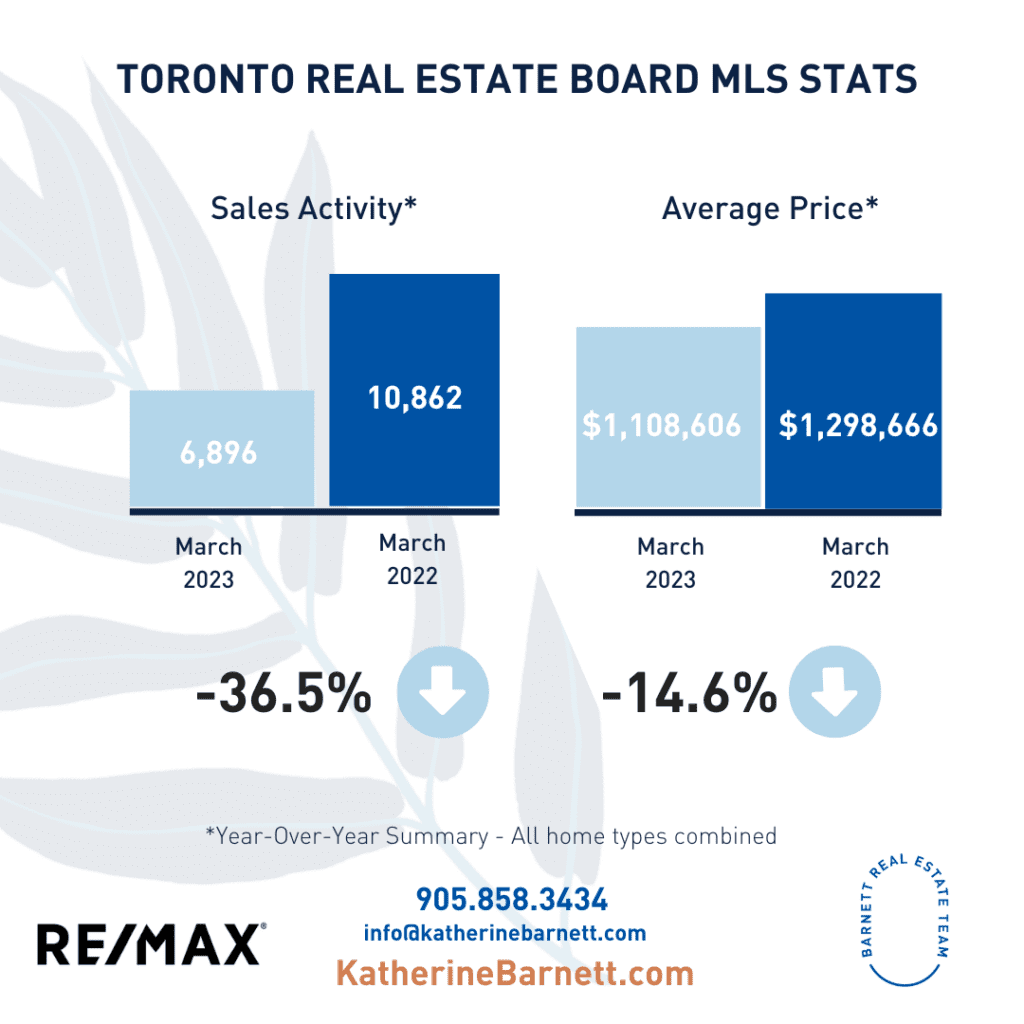

September 2023 – GTA Housing Market News

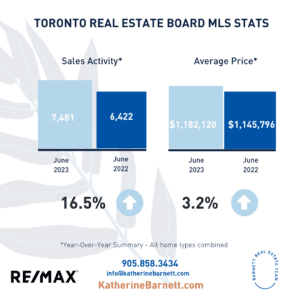

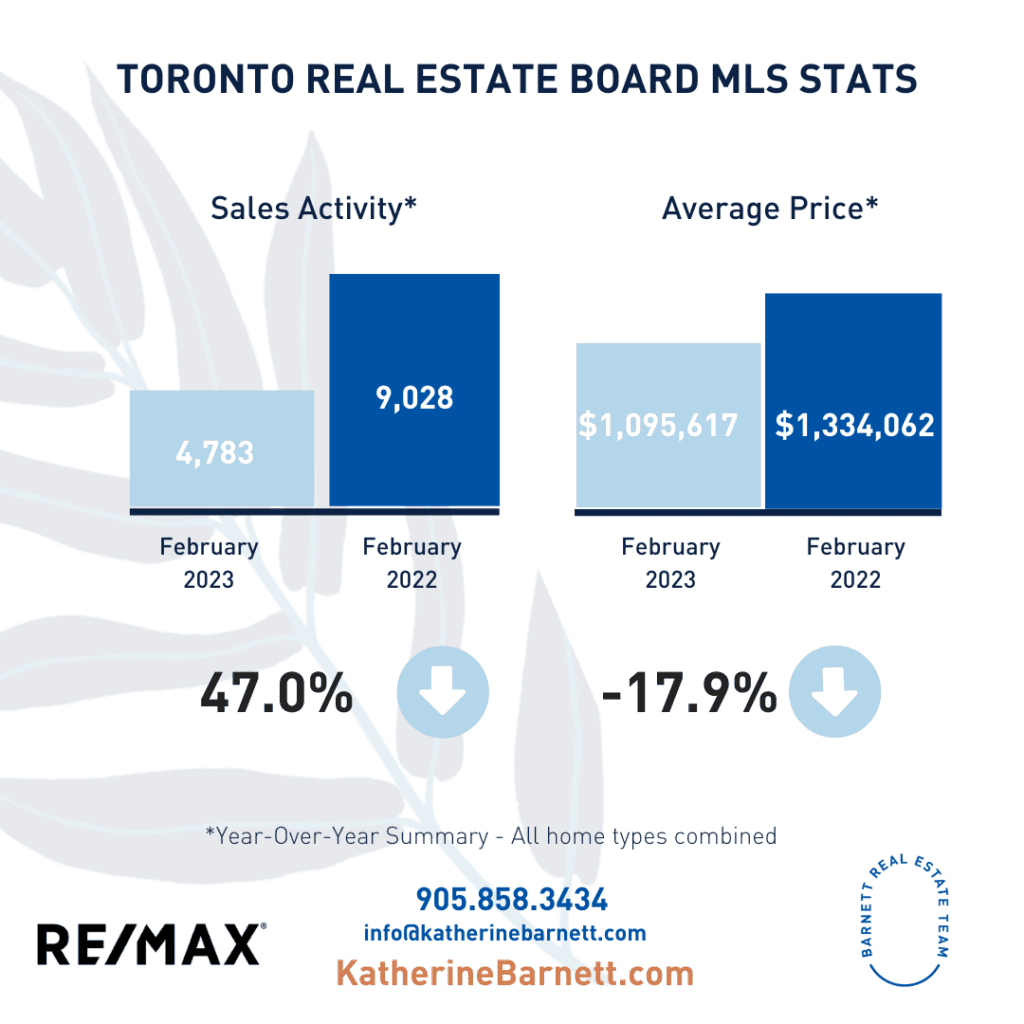

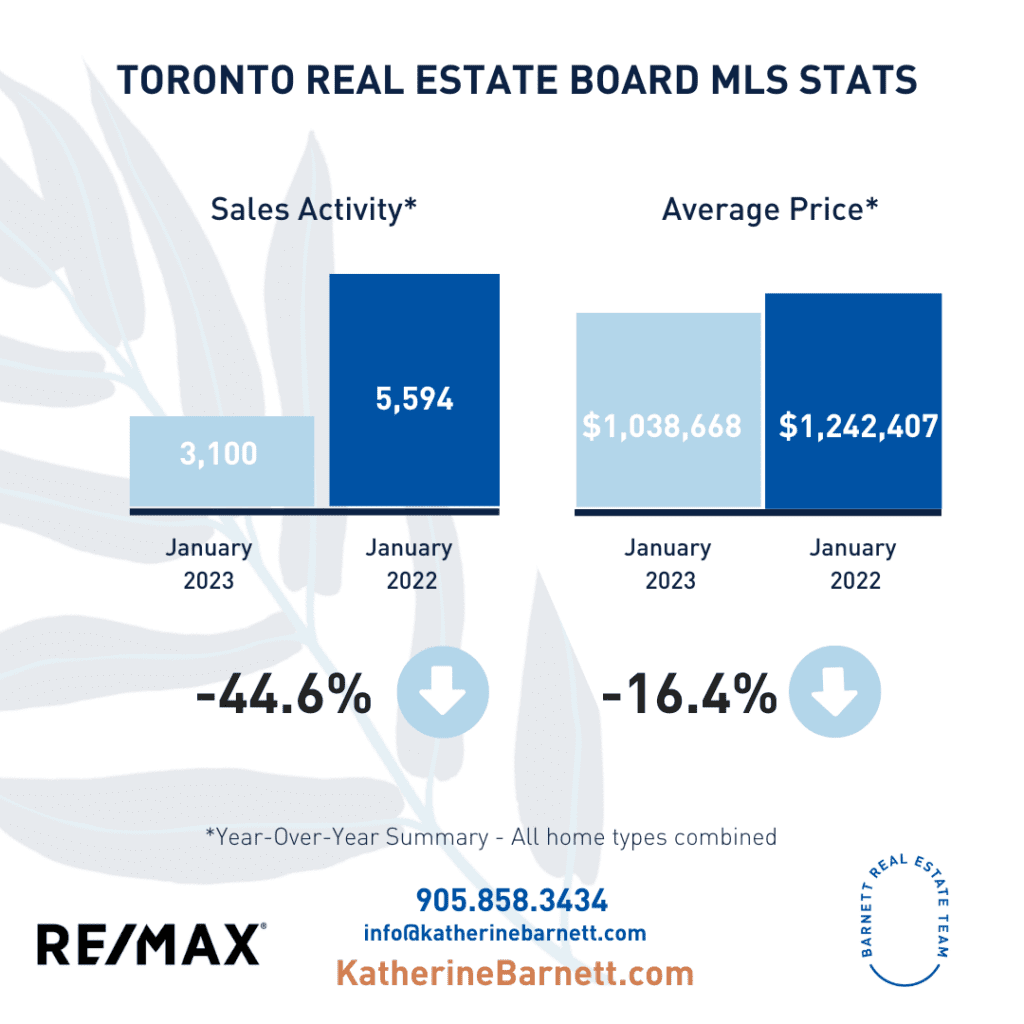

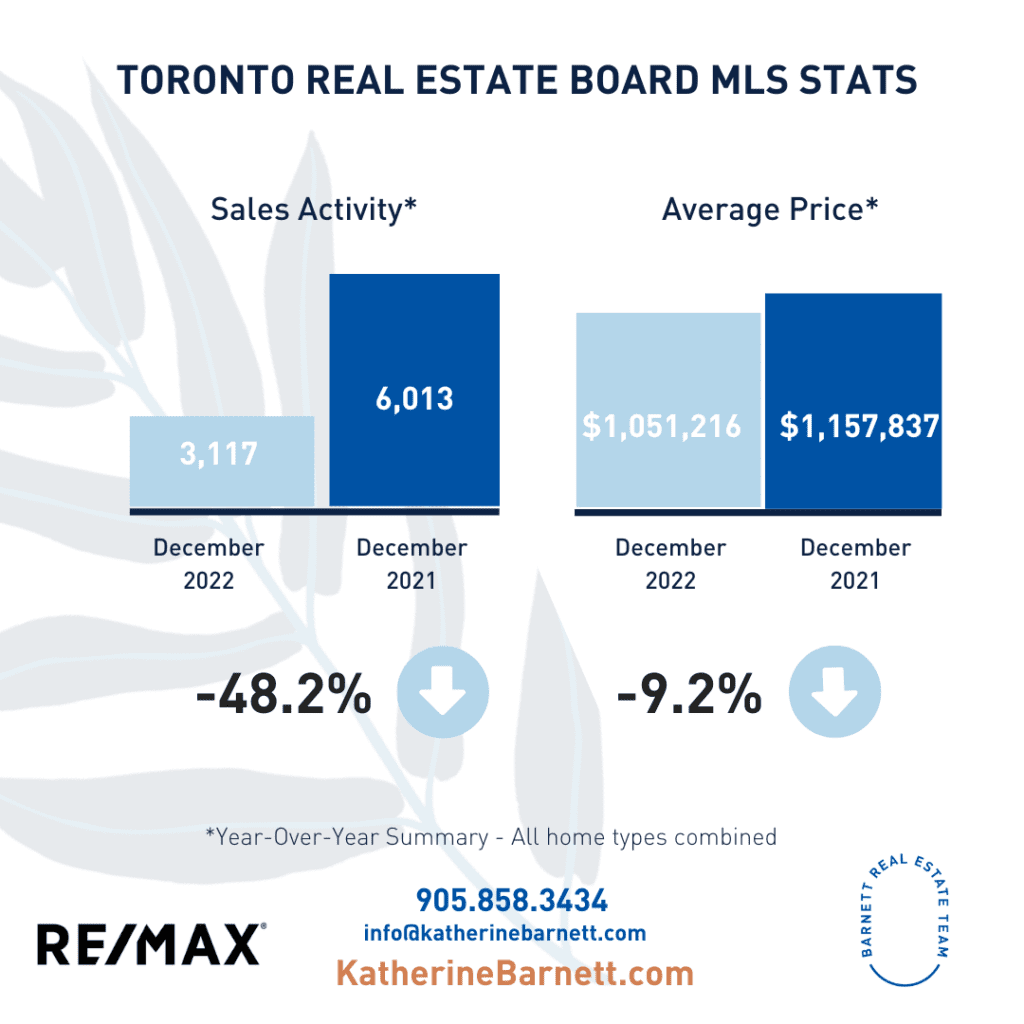

Here is our quick market update for the Toronto Real Estate Board and Milton area.

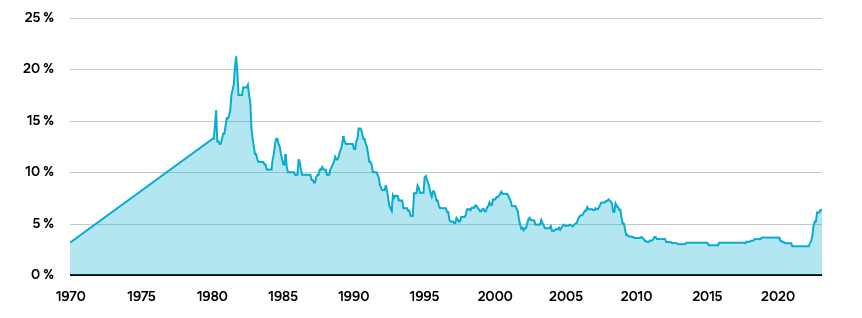

The real estate market in Milton and the Greater Toronto Area (GTA) is experiencing a surprising lack of a typical fall market surge. In September, sales were down by 7% compared to the previous year, and the average sale price only increased by 3%, which is less than expected. This indicates a balanced market, with over four months of inventory for townhomes and detached properties in Milton. Such a balance, typically observed with 3 to 5 months of inventory, implies that neither sellers nor buyers have a distinct advantage. Interest rates are predicted to remain high until the middle of 2024, making it challenging for potential buyers to enter the market. The real estate landscape appears uncertain, and its future direction remains to be seen.

If you have any inquiries regarding the market or your specific property, please do not hesitate to contact us at any time. We are here to assist you.

By: Katherine Barnett

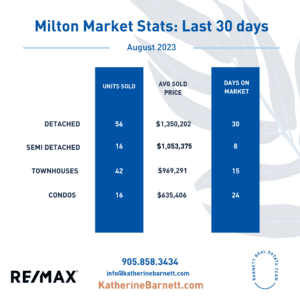

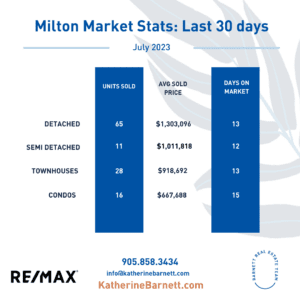

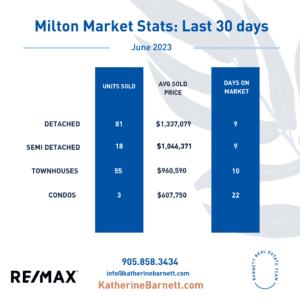

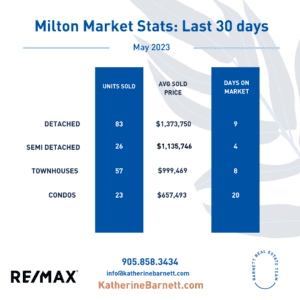

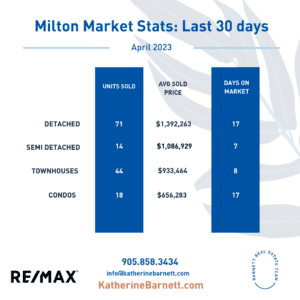

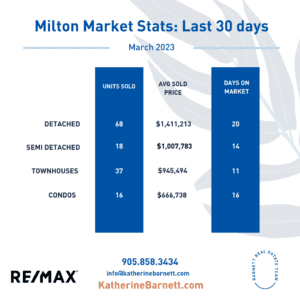

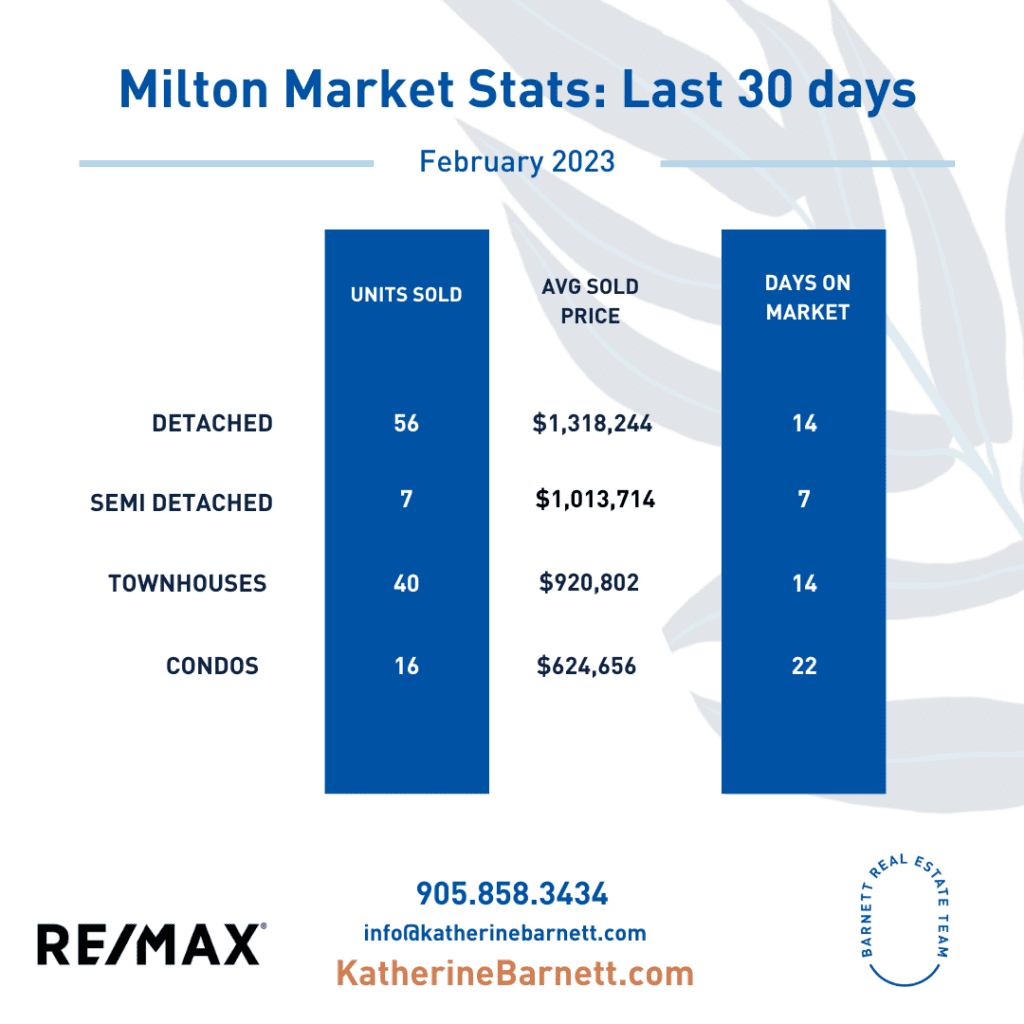

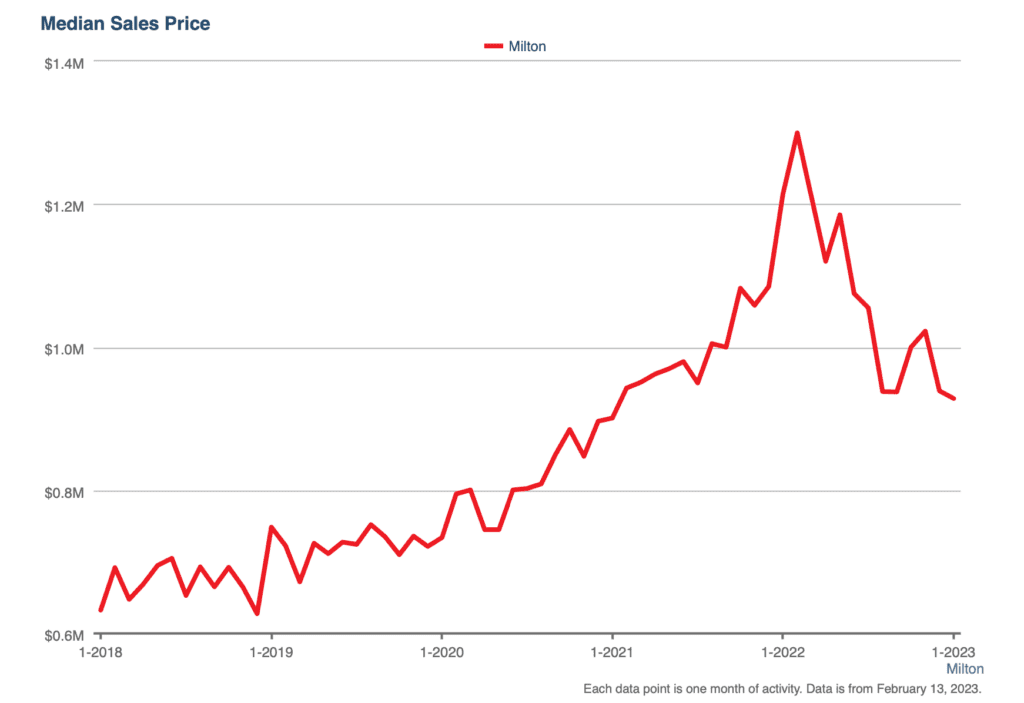

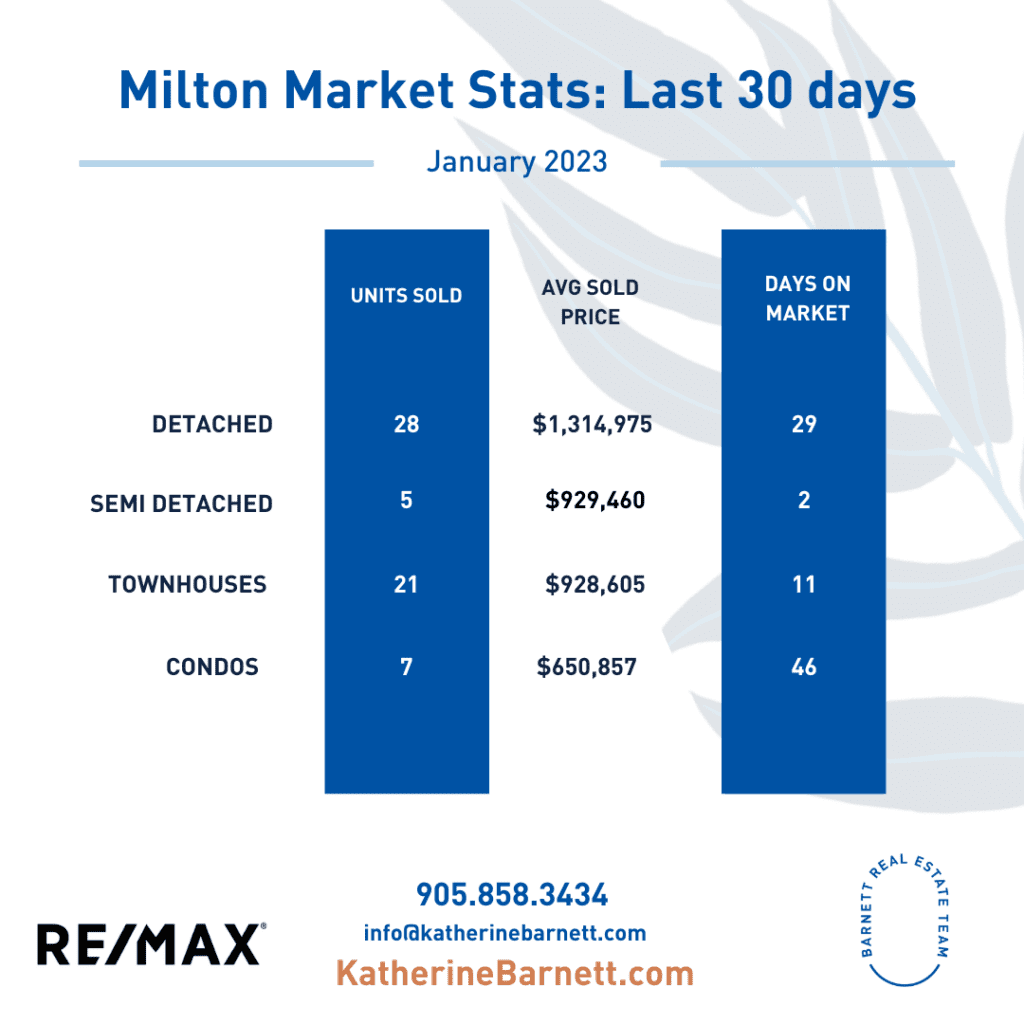

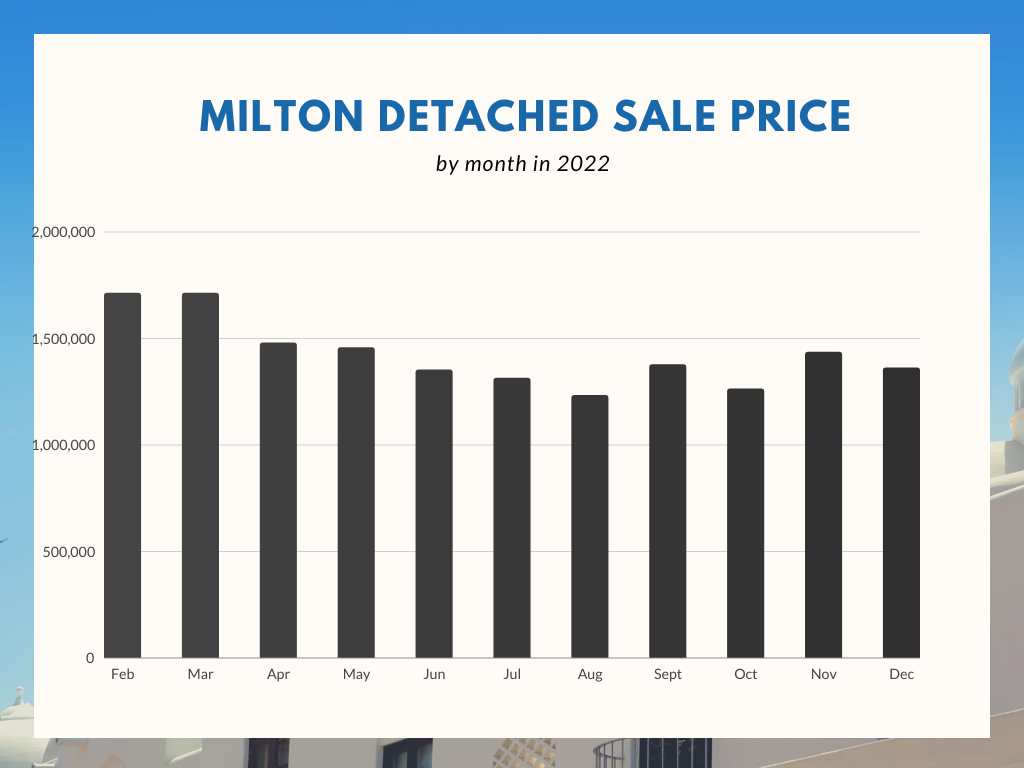

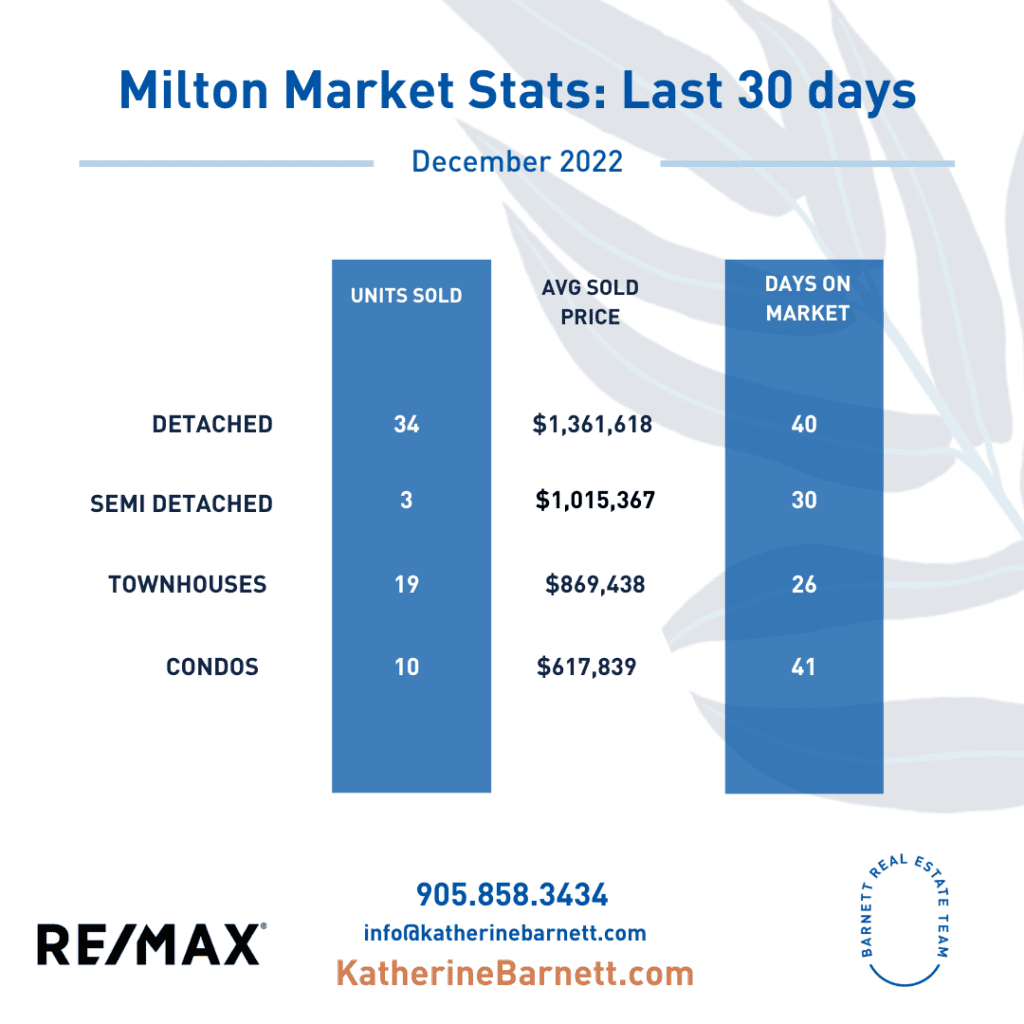

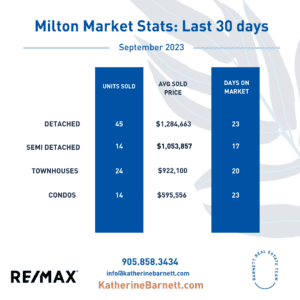

Milton Real Estate Market

The average price in Milton $1,053,783

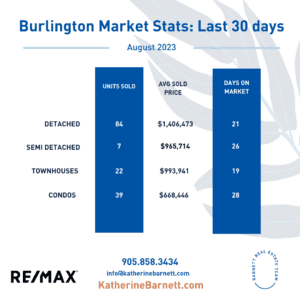

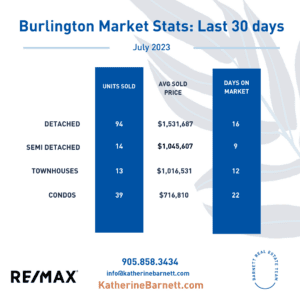

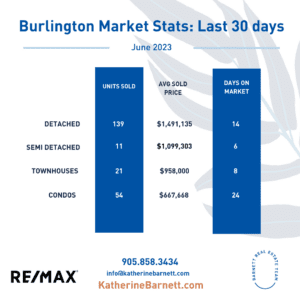

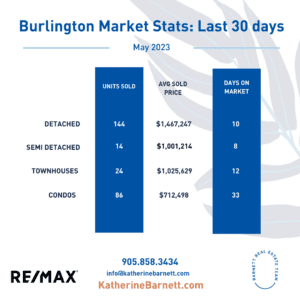

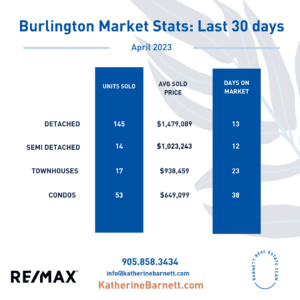

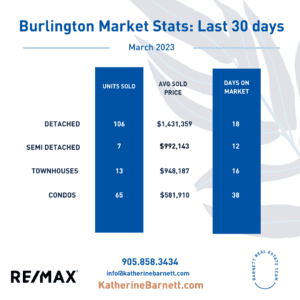

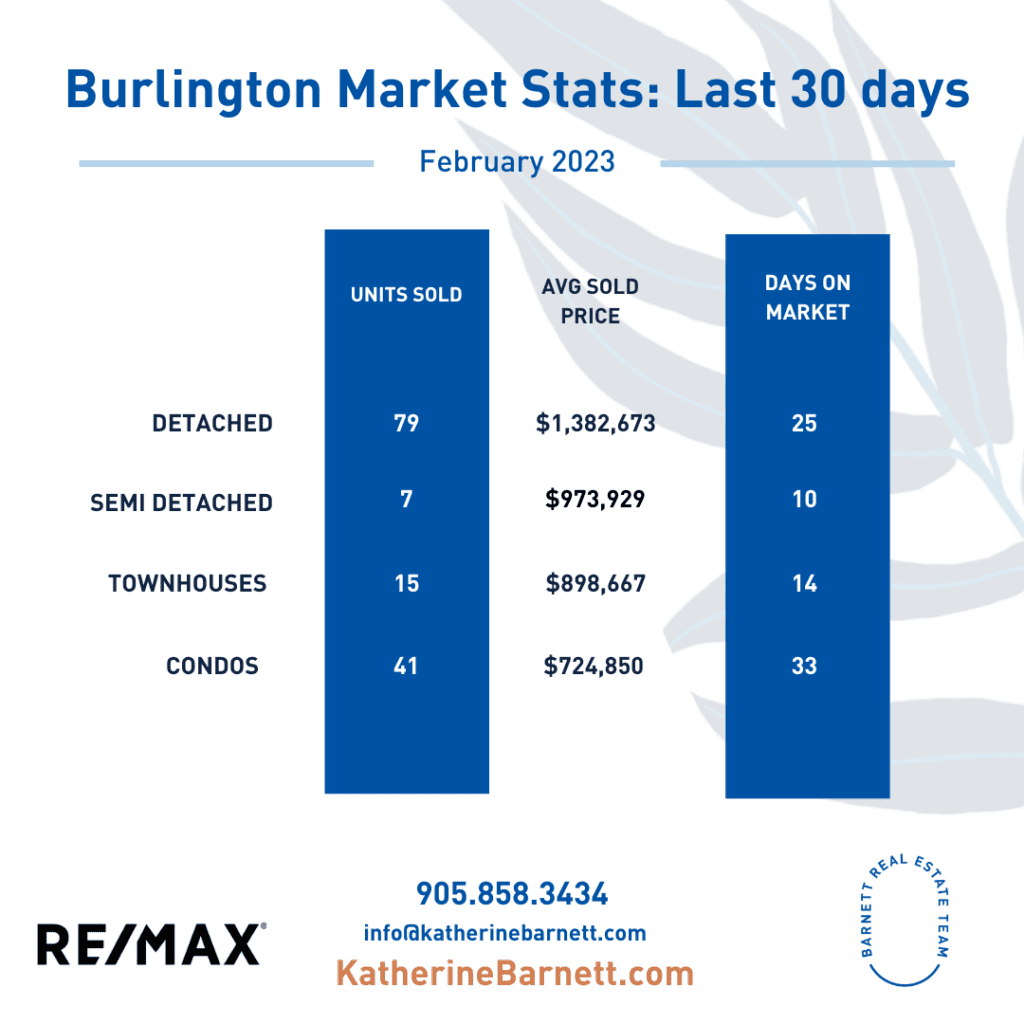

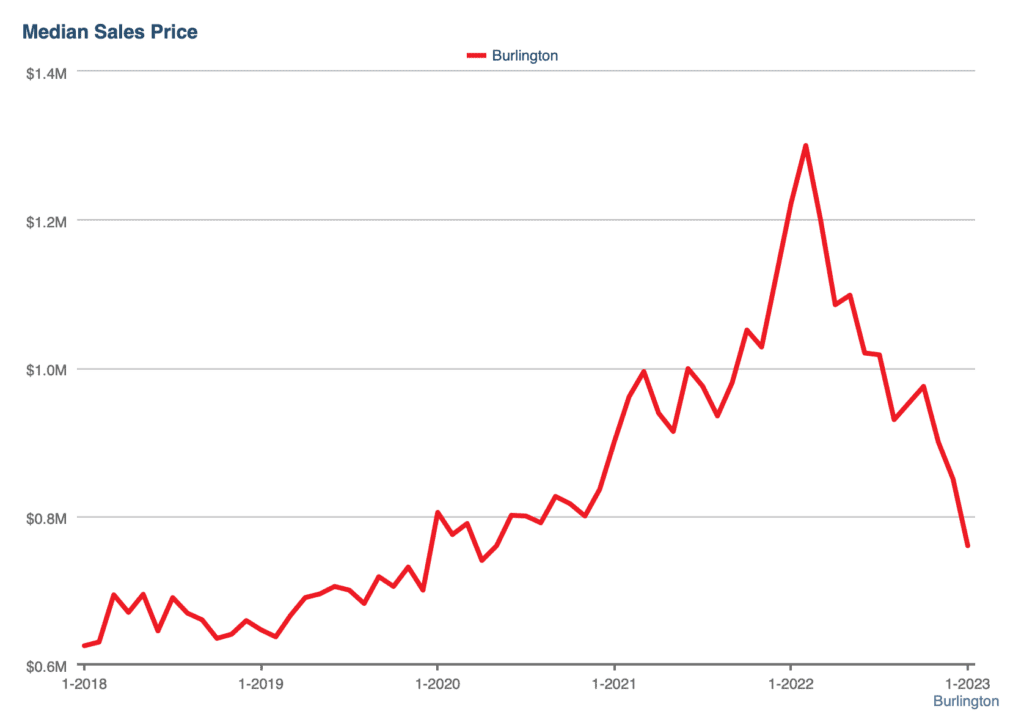

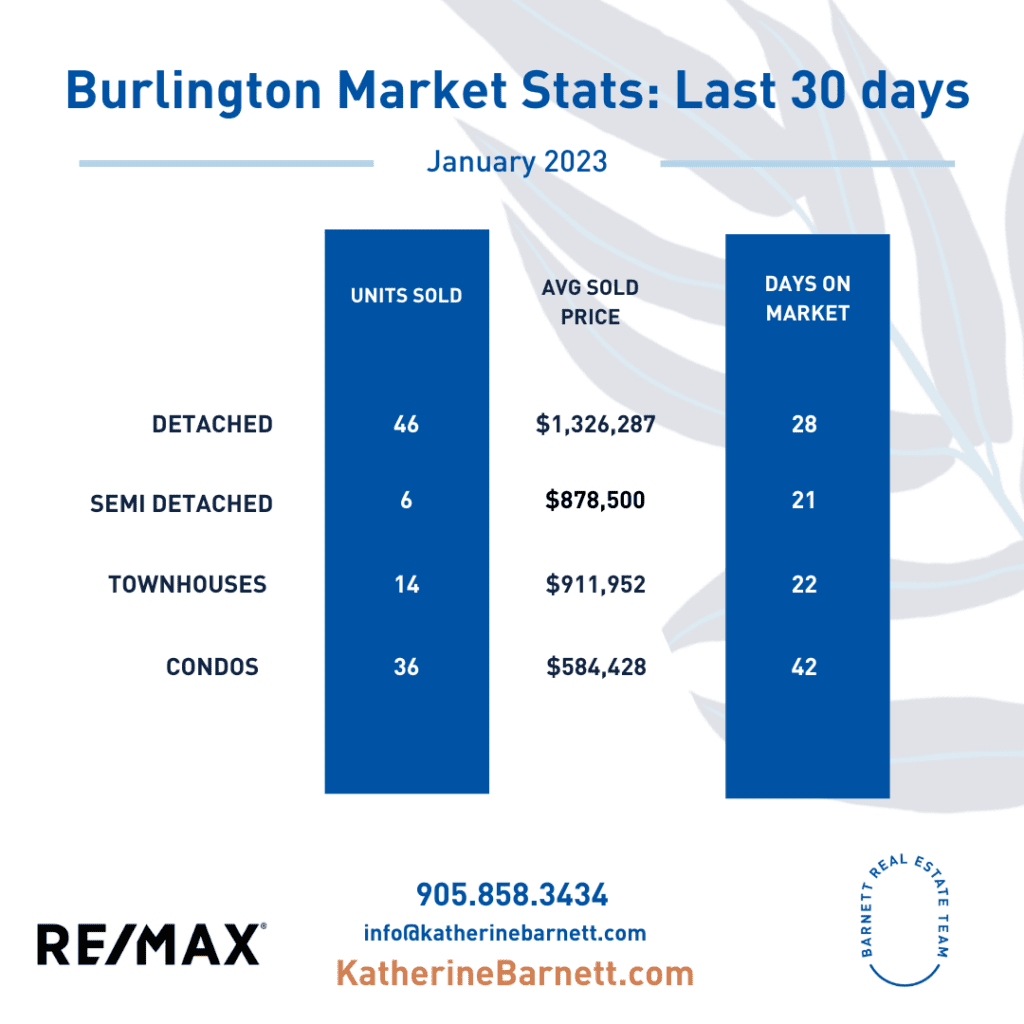

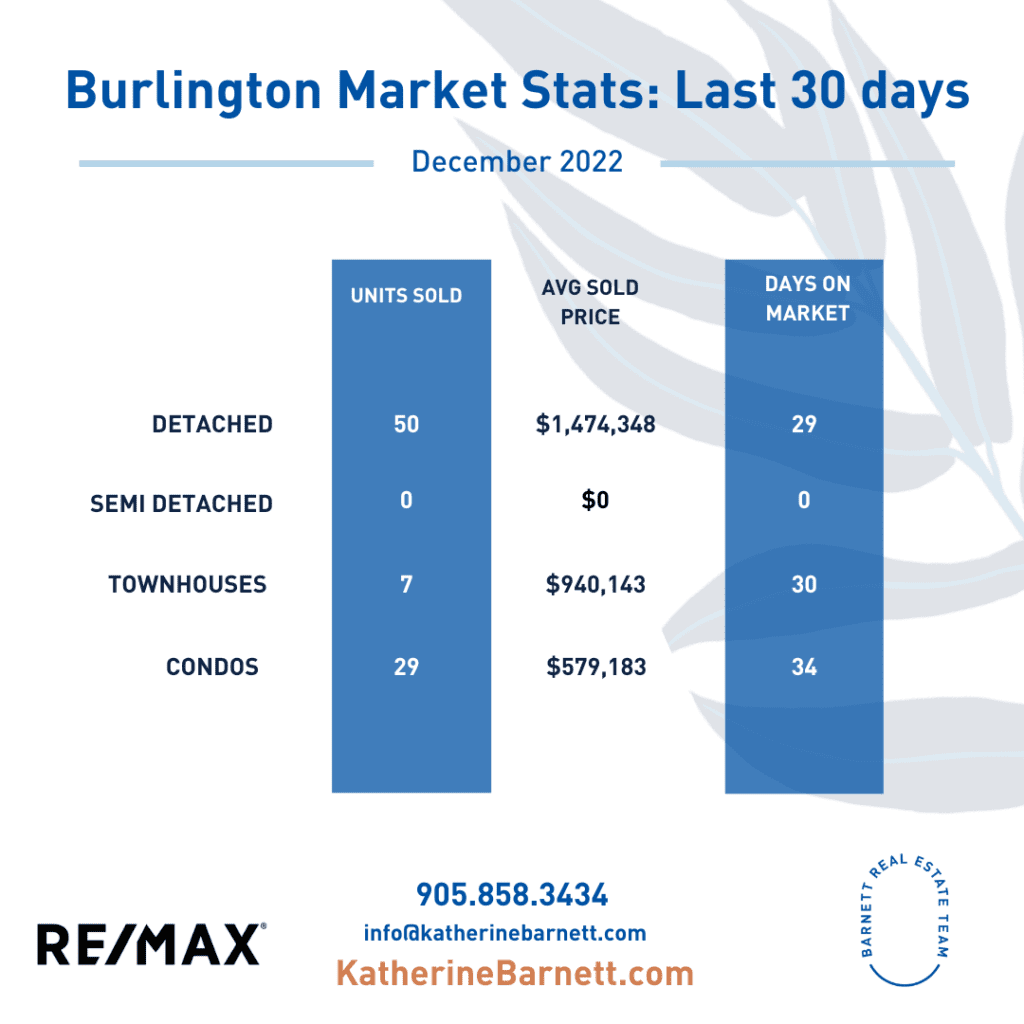

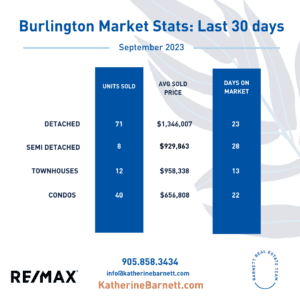

Burlington Real Estate Market

The average price in Burlington $1,049,362

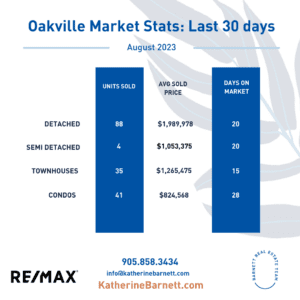

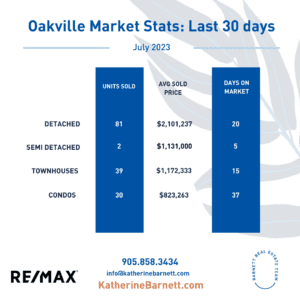

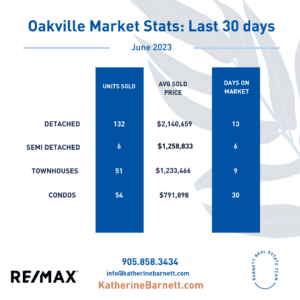

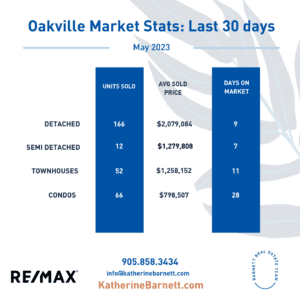

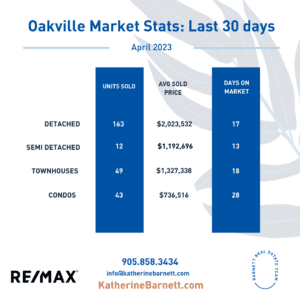

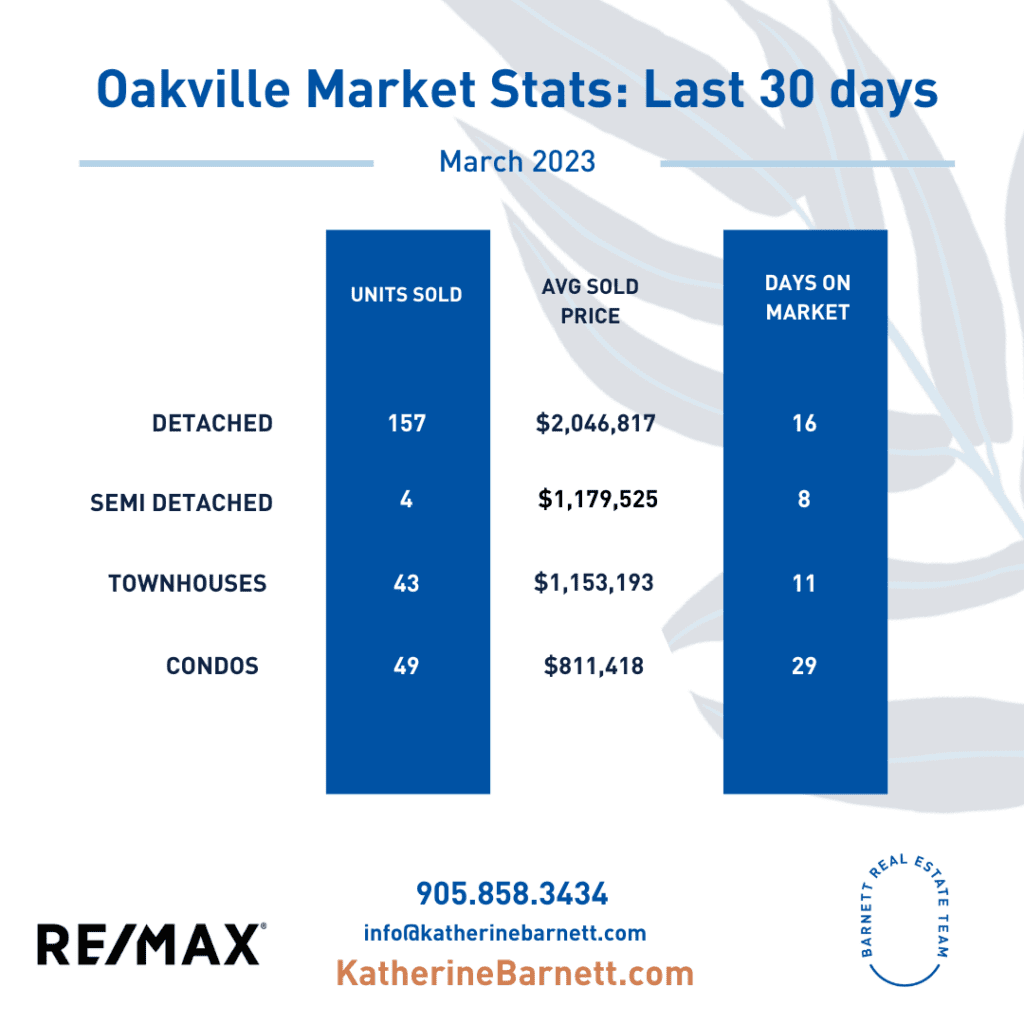

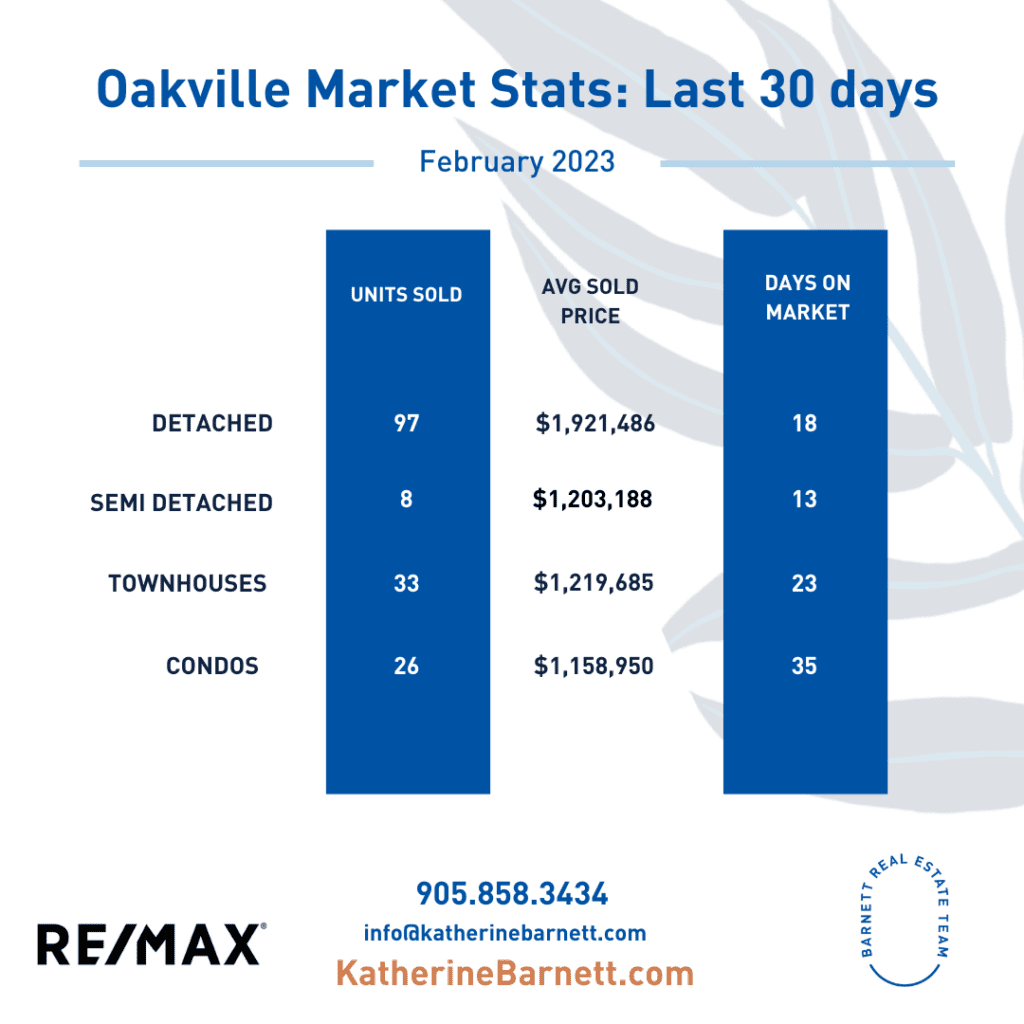

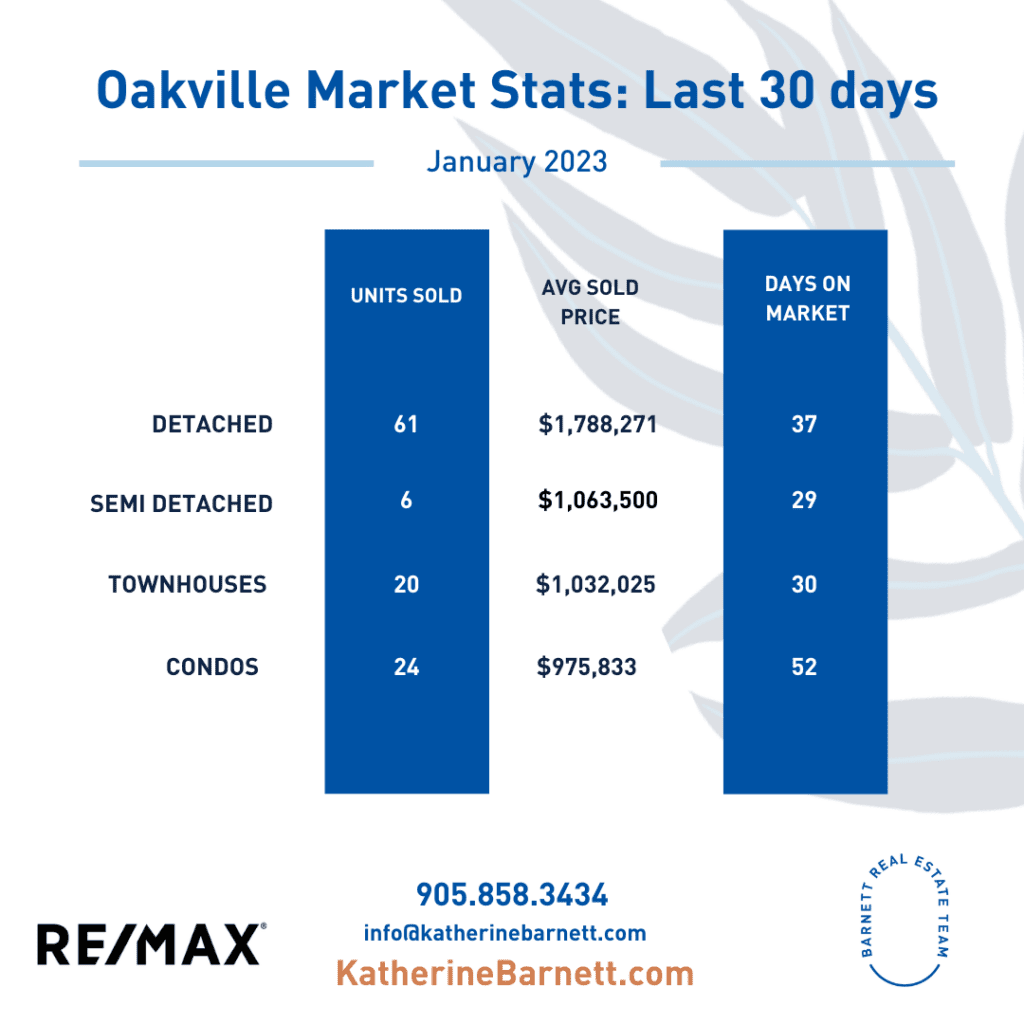

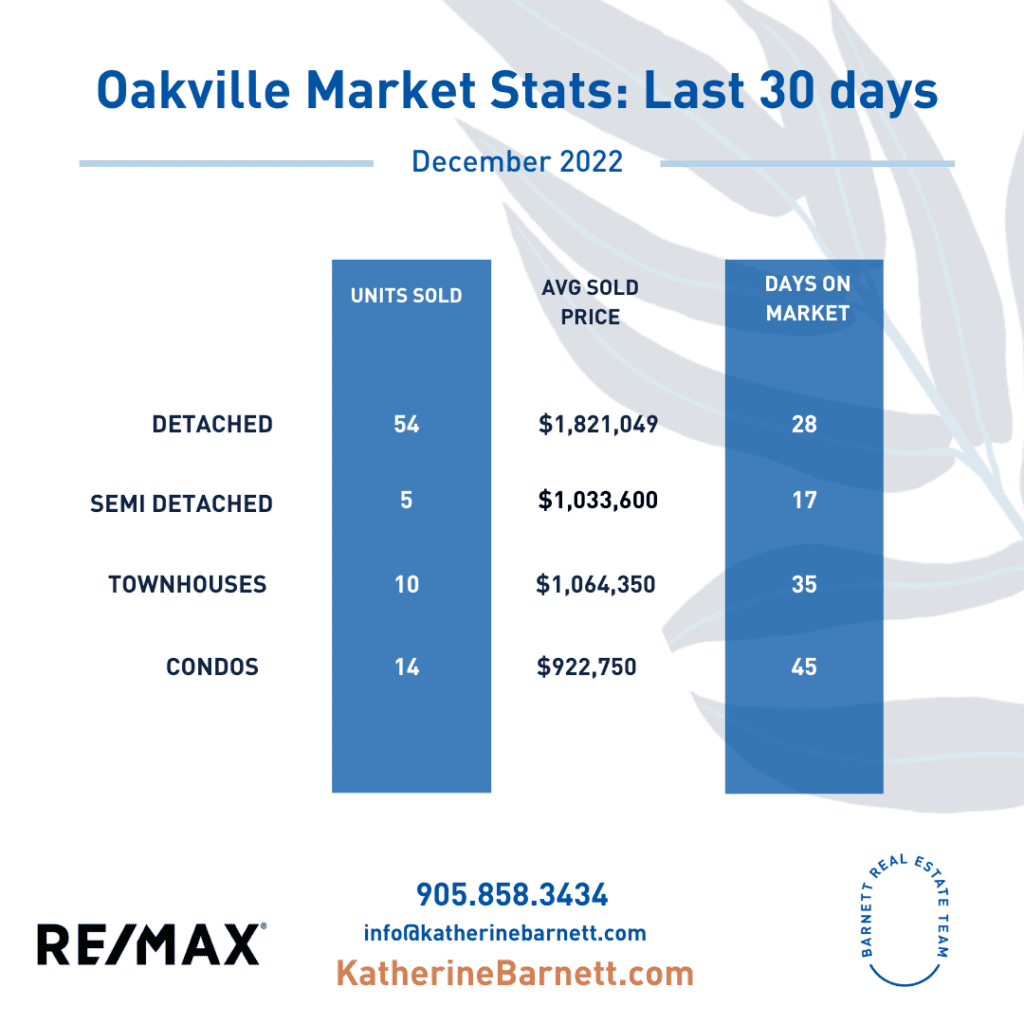

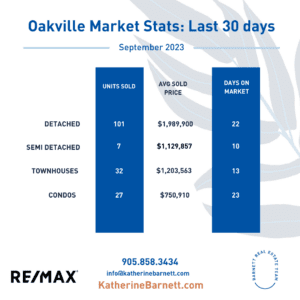

Oakville Real Estate Market

The average price in Oakville $1,551,189