January 2026– GTA Housing Market News

Here is our quick market update!

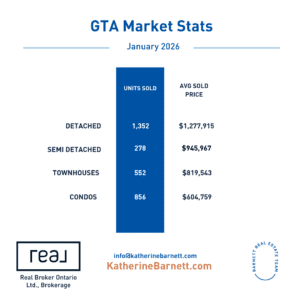

🏡 GTA Housing Market Update – January 2026

Market Activity Slows as Prices Continue to Ease

2025 just wrapped up with a little over 62,000 transactions. That makes it the slowest year for sales that we’ve seen since 1995. That was 31 years ago.

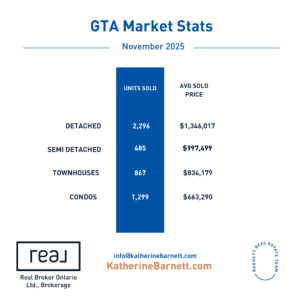

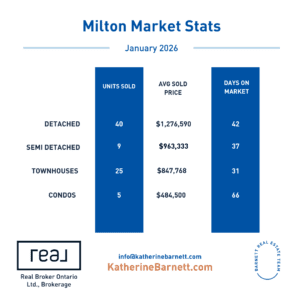

Across the GTA, transactions were down almost 20% compared to January last year. If we zoom in on the Milton market, sales were down 29%, with only 82 homes sold in January. The median price in Milton has held fairly steady compared to the last couple of January, whereas across the GTA, the prices are down about 6.5% year over year.

Some people are blaming the extremely cold weather that we’ve seen for the slow down. Maybe that’s part of it. But here’s the bigger picture. Interest rates have been coming down, and at the same time, prices have also been adjusting downward.

If you’re thinking about buying or selling this year, strategy matters more than ever.

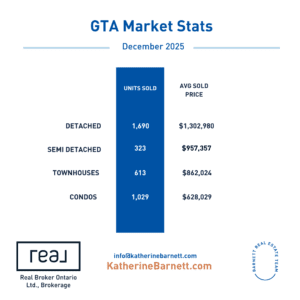

📊 January 2026 Market Snapshot

-

3,082 home sales

🔻 Down 19.3% vs. January 2025 -

10,774 new listings

🔻 Down 13.3% year-over-year -

Average selling price: $973,289

🔻 Down 6.5% vs. January 2025 -

MLS® Home Price Index (MLS® HPI) Composite Benchmark:

🔻 Down 8.0% year-over-year

On a seasonally adjusted basis, home sales declined month-over-month compared to December 2025, while new listings edged slightly higher. Both the MLS® Home Price Index (MLS® HPI) Composite and the average selling price continued to trend lower, reinforcing the affordability gains seen over the past year.

📉 What This Means for the Market

January’s numbers reflect a cautious start to the year, with many buyers remaining on the sidelines amid broader economic uncertainty. However, softer prices and easing market conditions may present opportunities for well-prepared buyers as 2026 unfolds.

📘 2026 Market Outlook Now Available

TRREB’s 2026 Market Outlook and Year in Review Report has been released and offers a comprehensive look at the GTA real estate landscape. The report includes insights on:

-

Residential resale trends

-

New home and condominium markets

-

Commercial real estate activity

-

Key economic drivers shaping the year ahead

📌 If you’re planning to buy, sell, or invest this year, this report is a valuable resource for understanding where the market may be headed.

Bottom Line:

While activity slowed in January, improving affordability and increased market insight set the stage for potential opportunities later in 2026—particularly as confidence returns and conditions stabilize.

All in all, it’s a market that favors buyers, but things can still move fast if the property hits the right price point. If you’re curious about what all this means for your home or area specifically, feel free to get in touch — we’re always happy to help.

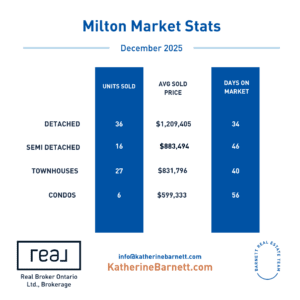

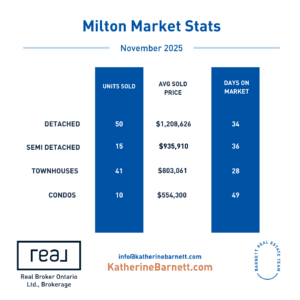

Milton Real Estate Market

The average price in Milton $1,046,516

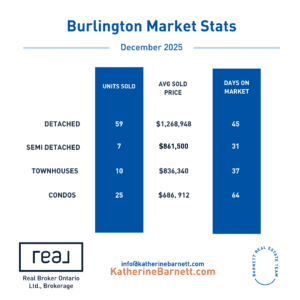

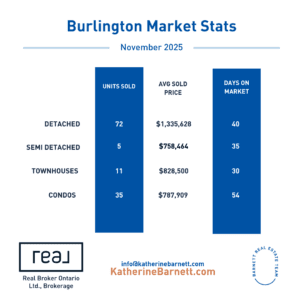

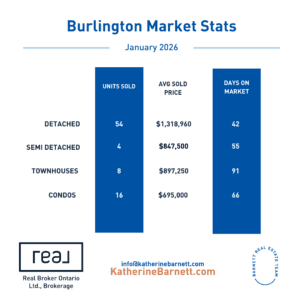

Burlington Real Estate Market

The average price in Burlington $1,031,580

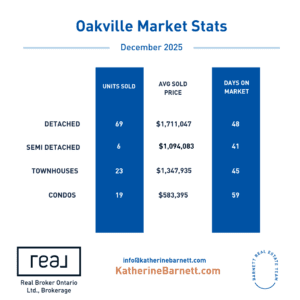

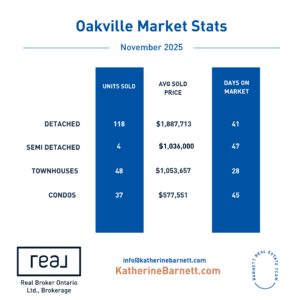

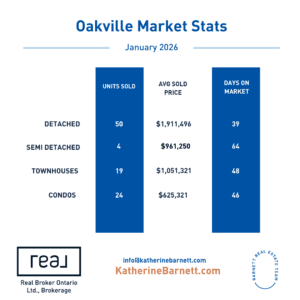

Oakville Real Estate Market

The average price in Oakville $1,330,082